Page 106 - Arthyog_FilBook_05 05 2024 (1)

P. 106

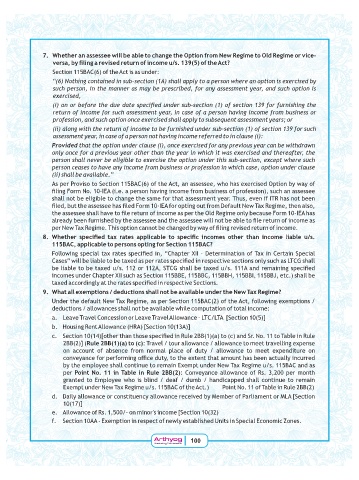

7. Whether an assessee will be able to change the Option from New Regime to Old Regime or vice-

versa, by filing a revised return of income u/s. 139(5) of the Act?

, +)'R* . + G

“(6) Nothing contained in sub-section (1A) shall apply to a person where an option is exercised by

such person, in the manner as may be prescribed, for any assessment year, and such option is

exercised,

(i) on or before the due date specified under sub-section (1) of section 139 for furnishing the

return of income for such assessment year, in case of a person having income from business or

profession, and such option once exercised shall apply to subsequent assessment years; or

(ii) along with the return of income to be furnished under sub-section (1) of section 139 for such

assessment year, in case of a person not having income referred to in clause (i):

Provided that the option under clause (i), once exercised for any previous year can be withdrawn

only once for a previous year other than the year in which it was exercised and thereafter, the

person shall never be eligible to exercise the option under this sub-section, except where such

person ceases to have any income from business or profession in which case, option under clause

(ii) shall be available.”

+ & " , +)'R* . + 1 / E& 1 .

? % < ! $;(9+ ' & " % ! . ! . & . *

% % ! . ! " . (

? ? < ! $;(9+ . & % . ! A . 1 / % !

" ? . ! & E % ! < ! $;(9+

. 1 ? . !

& 1 / % ! & % 1 . ? % " . !

8. Whether specified tax rates applicable to specific incomes other than income liable u/s.

115BAC, applicable to persons opting for Section 115BAC?

< 1 % & / & ? O) & W(( 3 A ! . / ) &

) P 1 / & & ? & " 0 )4

/ I = =+ )4 / I + ! % & ?

! ) & W(( , 9 , ) , 8 , ( , *

/ % & ? & "

9. What all exemptions / deductions shall not be available under the New Tax Regime?

B . 1 / % ! & , +)'=* . + . 1 % / !& I

I 1 " 1 !& . ! G

0 " " ) 0 " " + 1 3 0 )I0 + ] $',*^

8 % + 1 '8 +* ] $' -+*^

$' *] & ? = ' *' * ' *

= '=*^ 'Rule 2BB(1)(a) to (c)G " I 1 I 1 ! " % /&

. . ! ! & . I 1 ! /&

" . & . ! % F / !

!& ! 9/ !& 1 / % ! I , +)

& Point No. 11 in Table in Rule 2BB(2)G ) " 1 . - =$$ & !

% 9!& 1 I . I ! I && !

9/ !& 1 / % ! I , +) . + * . = '=*

A 1 1 " ! . ! 0+ ]

$' *^

+ 1 . ,$$I; ! C ! ] $'-=*

. $++ ; 9/ !& & . 1 B & 9 ! >

100