Page 108 - Arthyog_FilBook_05 05 2024 (1)

P. 108

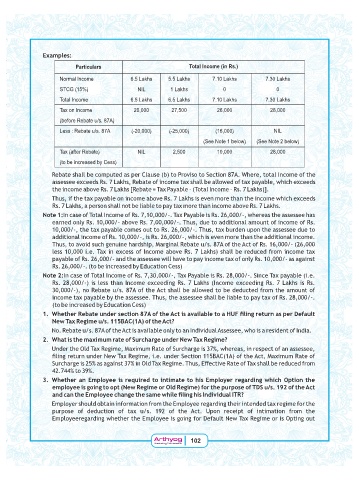

Examples:

Particulars Total Income (in Rs.)

Normal Income 6.5 Lakhs 5.5 Lakhs 7.10 Lakhs 7.30 Lakhs

STCG (15%) NIL 1 Lakhs 0 0

Total Income 6.5 Lakhs 6.5 Lakhs 7.10 Lakhs 7.30 Lakhs

Tax on Income 20,000 27,500 26,000 28,000

(before Rebate u/s. 87A)

Less : Rebate u/s. 87A (-20,000) (-25,000) (16,000) NIL

(See Note 1 below) (See Note 2 below)

Tax (after Rebate) NIL 2,500 10,000 28,000

(to be increased by Cess)

!& & ) ' * " # + 7 ! .

/ 0 . ! / 1 . / & 1 /

! " 0 ] b / 3 ' ( ! 3 0 *^

. / & ! " 0 " ! ! 1 /

0 & & / ! ! " 0

Note 1:( . ( ! . $ $$$I; / =R $$$I; 1

$ $$$I; " $$ $$$I; ! . ! .

$ $$$I; / & ! =R $$$I; / &

! . $ $$$I; =R $$$I; 1 " ! !

" % & % I # + . + . R $$$I; '=R $$$

$ $$$ / / . ( ! " 0 * . ! ! /

& . =R $$$I; 1 " & ! / . $ $$$I; %

=R $$$I; ' 9 ) *

Note 2:( . ( ! . -$ $$$I; / =# $$$I; / & '

=# $$$I;* ( ! / % 0 '( ! / % 0

-$ $$$I;* I # + . + 1 . ! ! .

! / & & / . =# $$$I;

' 9 ) *

1. Whether Rebate under section 87A of the Act is available to a HUF filing return as per Default

New Tax Regime u/s. 115BAC(1A) of the Act?

I # + . + " ( " + 1 . (

2. What is the maximum rate of Surcharge under New Tax Regime?

B E / % ! / ! ! . % - Y 1 & .

? % 1 / % ! , +)' +* . + / ! ! .

% =,Y % - Y E / % ! 9D " . / . !

= Y - Y

3. Whether an Employee is required to intimate to his Employer regarding which Option the

employee is going to opt (New Regime or Old Regime) for the purpose of TDS u/s. 192 of the Act

and can the Employee change the same while filing his Individual ITR?

9!& . ! . ! 9!& % % / % ! .

& & . . / I = . + B& & . ! . !

9!& % % 1 9!& % % . A . 1 / % ! E& %

102