Page 54 - FREN-C2021 PROCEEDINGS

P. 54

study will differ from previous studies in that we utilize a dataset of shariah-compliant firms. We

argue that due to the nature of the company (shariah complaint), the findings of the previous studies

cannot be generalized to this sample of firms. The second contribution is the use of variable selection

techniques. The analysis of the previous literature (see for example (Beretta, 2019) (Mohamad, 2019)

(Bikker, 2018)) suggest that decision with regards to the profitability is the consequence of many

factors. The variables in the models are selected based on their significance in a specific theory,

policy, or both. But as researchers disagree on what is the most important, it is usually only partial

overlap among the variables considered in different empirical papers. Therefore, it is very important

to investigate which of the independent variables suggested in the literature emerge as the most

significant determinants of profitability. In this study, we contend that the determinants of profitability

for the sample firms will be different due to their unique firm and country-specific characteristics,

hence, empirical findings from other research cannot be generalized to this study sample. In addition

to that, the robustness of the results of the previous studies needs to be examined against evidence

from other research and countries such as Malaysia. In this study, Stata command vselect will be used

to determine which variable should be included or excluded from the model.

Methods

Target Population and Data Collection Procedure

The target population for the research was all shariah-compliant firms listed under the consumer

products sector on Bursa Malaysia. Financial data of the selected samples are extracted from the

published annual reports obtained from Bursa Malaysia’s website and online databases such as

DataStream and Eikon. For each of the review periods, the information on the sample’s financial data

is extracted as of each financial year-end. Subsequently, the financial ratios of all the variables

(dependent and independent variables) are computed using the identified formulas. The final sample

consists of 40 firms.

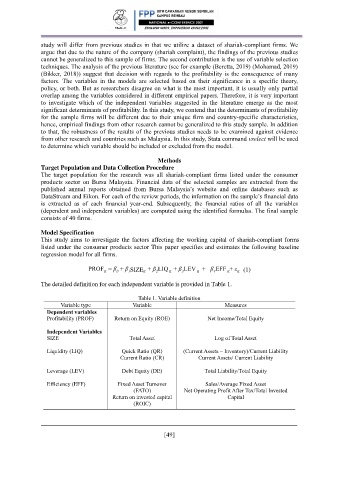

Model Specification

This study aims to investigate the factors affecting the working capital of shariah-compliant forms

listed under the consumer products sector This paper specifies and estimates the following baseline

regression model for all firms.

PROF = β + β SIZE it + β LIQ + β LEV + β EFF + ε (1)

3

it

it

1

0

2

it

it

it

4

The detailed definition for each independent variable is provided in Table 1.

Table 1. Variable definition

Variable type Variable Measures

Dependent variables

Profitability (PROF) Return on Equity (ROE) Net Income/Total Equity

Independent Variables

SIZE Total Asset Log of Total Asset

Liquidity (LIQ) Quick Ratio (QR) (Current Assets – Inventory)/Current Liability

Current Ratio (CR) Current Assets/ Current Liability

Leverage (LEV) Debt Equity (DE) Total Liability/Total Equity

Efficiency (EFF) Fixed Asset Turnover Sales/Average Fixed Asset

(FATO) Net Operating Profit After Tax/Total Invested

Return on invested capital Capital

(ROIC)

[49]