Page 107 - 2021 ANNUAL REPORT draft

P. 107

Liquidity risk a) Liquidity Risk Governance

The Board of Directors retains ultimate responsibility for the effective management of liquidity risk. Through

the Enterprise Risk Management Group (ERM), the board has delegated its responsibility for the

management of liquidity risk to the Asset and Liability Management Committee (ALMAC).

b) Liquidity Risk Management

A brief overview of the bank's liquidity management processes during the year includes the following:

1. Maintenance of minimum levels of liquid and marketable assets above the regulatory requirement

of 30%. The Bank has also set for itself more stringent in-house limits above this regulatory

requirement to which it adheres.

2. Monitoring of its cash flow and balance sheet trends. The Bank also makes forecasts of anticipated

deposits and withdrawals to determine their potential effect on the Bank.

3. Regular measurement & monitoring of its liquidity position/ratios in line with regulatory requirements

and in-house limits

4. Regular monitoring of non-earning assets

5. Monitoring of deposit concentration

6. Ensure diversification of funding sources

7. Monitoring of level of undrawn commitments

8. Maintaining a contingency funding plan.

c) Liquidity Risk Measurement

There are two measures used for managing liquidity risk namely: liquidity ratio mechanism which is a

statutory requirement from most Central Bank in order to protect third party deposits, and funding gap

analysis of assets and liabilities.

i) Liquidity ratios

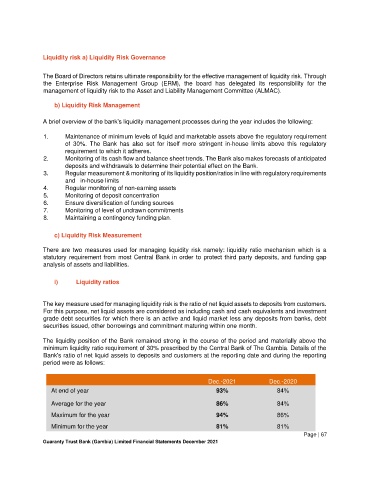

The key measure used for managing liquidity risk is the ratio of net liquid assets to deposits from customers.

For this purpose, net liquid assets are considered as including cash and cash equivalents and investment

grade debt securities for which there is an active and liquid market less any deposits from banks, debt

securities issued, other borrowings and commitment maturing within one month.

The liquidity position of the Bank remained strong in the course of the period and materially above the

minimum liquidity ratio requirement of 30% prescribed by the Central Bank of The Gambia. Details of the

Bank's ratio of net liquid assets to deposits and customers at the reporting date and during the reporting

period were as follows:

Dec.-2021 Dec.-2020

At end of year 93% 84%

Average for the year 86% 84%

Maximum for the year 94% 86%

Minimum for the year 81% 81%

Page | 67

Guaranty Trust Bank (Gambia) Limited Financial Statements December 2021