Page 112 - 2021 ANNUAL REPORT draft

P. 112

is to manage and control market risk exposures within acceptable parameter, while optimizing the return

on risk.

Management of Market Risk

The Bank separates its exposure to market risk between trading and non-trading portfolios. Trading

portfolios are mainly held by the Treasury Division, and include positions arising from market making and

proprietary position taking, together with financial assets and liabilities that are managed on a fair value

basis. All foreign exchange risks within the Bank are monitored by the Treasury Division. Accordingly, the

foreign exchange position is treated as part of the Bank's trading portfolios for risk management purposes.

Overall authority for market risk is vested in Market Risk Management Unit. However, the Market Risk

Management Unit within the Enterprise-wide Risk Management Division is responsible for the development

of detailed risk management policies (subject to review and approval by the Committee) and for the dayto-

day review of their implementation.

Exposure to Market Risk-Trading Portfolios

The principal tool used to measure and control market risk exposure within the Bank's trading portfolios is

the open position limits using the Earning-at Risk approach. Specific limits (regulatory and in- house)

have been set across the various trading portfolios to prevent undue exposure and the market risk

management Bank ensures that these limits and triggers are adhered to by the bank.

Page | 71

Guaranty Trust Bank (Gambia) Limited Financial Statements December 2021

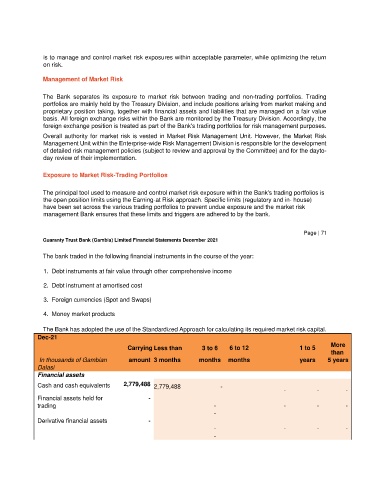

The bank traded in the following financial instruments in the course of the year:

1. Debt instruments at fair value through other comprehensive income

2. Debt instrument at amortised cost

3. Foreign currencies (Spot and Swaps)

4. Money market products

The Bank has adopted the use of the Standardized Approach for calculating its required market risk capital.

Dec-21

More

Carrying Less than 3 to 6 6 to 12 1 to 5

than

In thousands of Gambian amount 3 months months months years 5 years

Dalasi

Financial assets

Cash and cash equivalents 2,779,488 2,779,488 -

- - -

Financial assets held for -

trading - - - -

-

Derivative financial assets -

- - - -

-