Page 108 - 2021 ANNUAL REPORT draft

P. 108

ii) Funding Approach

The Bank's overall approach to funding is as follows:

1. Generation of large pool of low cost deposits.

2. Maintenance of efficiently diversified sources of funds along product lines, business segments and also

regions to avoid concentration risk.

The bank was able to meet all its financial commitments and obligations without any liquidity risk exposure

in the course of the year.

The bank's Asset and Liability Management Committee (ALMAC) is charged with the responsibility of

managing the Bank's daily liquidity position. A daily liquidity position is monitored and regular liquidity stress

testing is conducted under a variety of scenarios covering both normal and more severe market conditions.

All liquidity policies and procedures are subject to review and approval policies and procedures are subject

to review and approval by ALMAC. The Risk Management Bank sets limits which are in conformity with the

regulatory limits. The limits are monitored regularly and exceptions are reported to ALMAC as appropriate.

In addition gap reports are prepared monthly to measure the maturity mismatches between assets and

liabilities. The cumulative gap over total assets is not expected to exceed 20%.

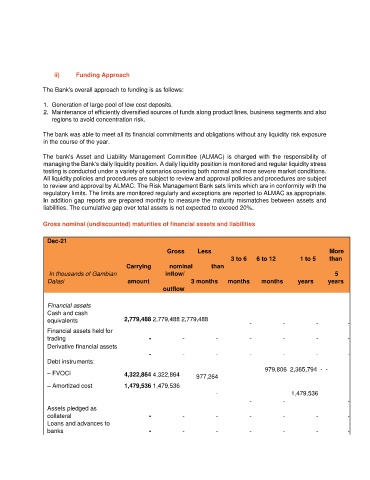

Gross nominal (undiscounted) maturities of financial assets and liabilities

Dec-21

Gross Less More

3 to 6 6 to 12 1 to 5 than

Carrying nominal than

In thousands of Gambian inflow/ 5

Dalasi amount 3 months months months years years

outflow

Financial assets

Cash and cash

equivalents 2,779,488 2,779,488 2,779,488

- - - -

Financial assets held for

trading - - - - - - -

Derivative financial assets

- - - - - - -

Debt instruments:

– FVOCI 4,322,864 4,322,864 977,264 979,806 2,365,794 - -

– Amortized cost 1,479,536 1,479,536

- 1,479,536

- - -

Assets pledged as

collateral - - - - - - -

Loans and advances to

banks - - - - - - -