Page 111 - 2021 ANNUAL REPORT draft

P. 111

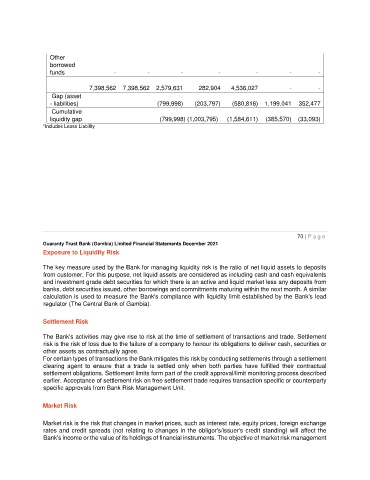

Other

borrowed

funds - - - - - - -

7,398,562 7,398,562 2,579,631 282,904 4,536,027 - -

Gap (asset

- liabilities) (799,998) (203,797) (580,816) 1,199,041 352,477

Cumulative

liquidity gap (799,998) (1,003,795) (1,584,611) (385,570) (33,093)

*Includes Lease Liability

70 | P a g e

Guaranty Trust Bank (Gambia) Limited Financial Statements December 2021

Exposure to Liquidity Risk

The key measure used by the Bank for managing liquidity risk is the ratio of net liquid assets to deposits

from customer. For this purpose, net liquid assets are considered as including cash and cash equivalents

and investment grade debt securities for which there is an active and liquid market less any deposits from

banks, debt securities issued, other borrowings and commitments maturing within the next month. A similar

calculation is used to measure the Bank's compliance with liquidity limit established by the Bank's lead

regulator (The Central Bank of Gambia).

Settlement Risk

The Bank's activities may give rise to risk at the time of settlement of transactions and trade. Settlement

risk is the risk of loss due to the failure of a company to honour its obligations to deliver cash, securities or

other assets as contractually agree.

For certain types of transactions the Bank mitigates this risk by conducting settlements through a settlement

clearing agent to ensure that a trade is settled only when both parties have fulfilled their contractual

settlement obligations. Settlement limits form part of the credit approval/limit monitoring process described

earlier. Acceptance of settlement risk on free settlement trade requires transaction specific or counterparty

specific approvals from Bank Risk Management Unit.

Market Risk

Market risk is the risk that changes in market prices, such as interest rate, equity prices, foreign exchange

rates and credit spreads (not relating to changes in the obligor's/issuer's credit standing) will affect the

Bank's income or the value of its holdings of financial instruments. The objective of market risk management