Page 43 - GTBank Annual Report 2020 eBook

P. 43

practices, including an effective system of internal give all stakeholders confidence in the resulting

control, to determine adequate expected credit financial information.

loss (ECL) allowances in accordance with IFRS 9

as well as the Bank’s stated policies and relevant The Bank’s Core Banking Application (BANKS)

supervisory guidance. and the Credit Risk Management rating system

are the key pillars of the IFRS 9 model. For the

Guaranty Trust Bank has instituted an effective purpose of estimating expected credit loss as

governance and control framework around the prescribed by the standard, the Bank has

IFRS 9 processes to ensure: that data integrity designed an ECL framework that generates data

and availability is upheld, expert judgement is from the banking system which is processed by

adopted in the design of the ECL models and the Credit Risk Management and Financial

finally the IFRS 9 processes are automated to Control Unit and transformed into IFRS 9

compliant figures.

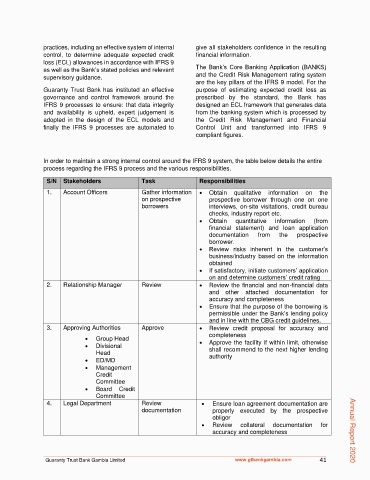

In order to maintain a strong internal control around the IFRS 9 system, the table below details the entire

process regarding the IFRS 9 process and the various responsibilities.

S/N Stakeholders Task Responsibilities

1. Account Officers Gather information • Obtain qualitative information on the

on prospective prospective borrower through one on one

borrowers interviews, on-site visitations, credit bureau

checks, industry report etc.

• Obtain quantitative information (from

financial statement) and loan application

documentation from the prospective

borrower.

• Review risks inherent in the customer’s

business/industry based on the information

obtained

• If satisfactory, initiate customers’ application

on and determine customers’ credit rating

2. Relationship Manager Review • Review the financial and non-financial data

and other attached documentation for

accuracy and completeness

• Ensure that the purpose of the borrowing is

permissible under the Bank’s lending policy

and in line with the CBG credit guidelines.

3. Approving Authorities Approve • Review credit proposal for accuracy and

completeness

• Group Head • Approve the facility if within limit, otherwise

• Divisional shall recommend to the next higher lending

Head authority

• ED/MD

• Management

Credit

Committee

• Board Credit

Committee

4. Legal Department Review • Ensure loan agreement documentation are

documentation properly executed by the prospective

obligor

• Review collateral documentation for

accuracy and completeness Annual Report 2020

Guaranty Trust Bank Gambia Limited www.gtbankgambia.com 41