Page 45 - GTBank Annual Report 2020 eBook

P. 45

3.8. Property, equipment and right- The cost of replacing part of an item of property

of-use assets or equipment is recognized in the carrying

Recognition and measurement amount of the item if it is probable that the future

The bank recognizes items of property, plant and economic benefits embodied within the part will

equipment at the time the cost is incurred. These flow to the Bank and its cost can be measured

costs include costs incurred initially to acquire or reliably. The carrying amount of the replaced part

construct an item of property and equipment. Its is derecognized. The costs of the day-to- day

cost also includes the costs of its dismantlement, servicing of property and equipment are

removal or restoration, the obligation for which an recognized in the income statement as incurred.

entity incurs as a consequence of using the item

during a particular year. (ii) Depreciation

Items of property and equipment are measured at Depreciation is recognized in the income

cost less accumulated depreciation and statement on a straight-line basis to write down

impairment losses. Cost includes expenditures the cost of each asset, to their residual values

that are directly attributable to the acquisition of over the estimated useful lives of each part of an

the asset. When parts of an item of property or item of property and equipment.

equipment have different useful lives, they are Depreciation begins when an asset is available

accounted for as separate items (major for use and ceases at the earlier of the date that

components) of property and equipment. the asset is derecognized or classified as held for

The assets’ carrying values and useful lives are sale in accordance with IFRS 5. A non-current

reviewed, and written down if appropriate, at each asset or disposal group is not depreciated while it

date of the Statements of financial position. is classified as held for sale.

Assets are impaired whenever events or changes

in circumstances indicate that the carrying

amount is less than the recoverable amount; see (iii) Right-of-use assets

note (s) on impairment of non-financial assets. are depreciated on a

straight-line basis

over the lease term.

(i) Subsequent costs

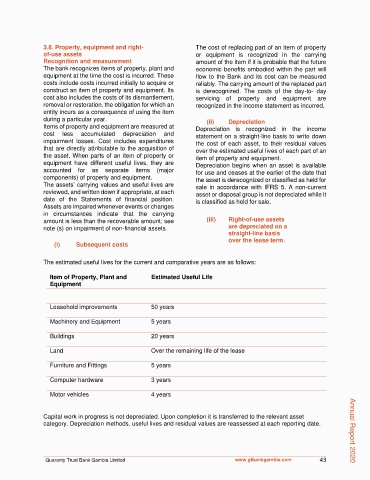

The estimated useful lives for the current and comparative years are as follows:

Item of Property, Plant and Estimated Useful Life

Equipment

Leasehold improvements 50 years

Machinery and Equipment 5 years

Buildings 20 years

Land Over the remaining life of the lease

Furniture and Fittings 5 years

Computer hardware 3 years

Motor vehicles 4 years

Capital work in progress is not depreciated. Upon completion it is transferred to the relevant asset

category. Depreciation methods, useful lives and residual values are reassessed at each reporting date.

Annual Report 2020

Guaranty Trust Bank Gambia Limited www.gtbankgambia.com 43