Page 44 - GTBank Annual Report 2020 eBook

P. 44

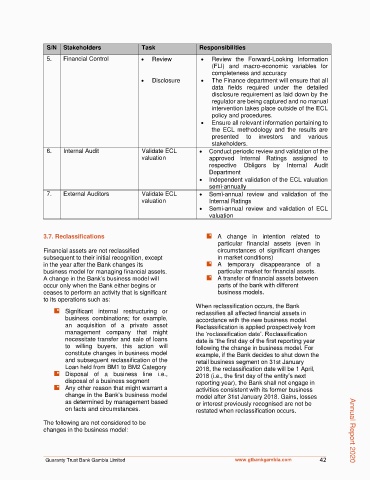

S/N Stakeholders Task Responsibilities

5. Financial Control • Review • Review the Forward-Looking Information

(FLI) and macro-economic variables for

completeness and accuracy

• Disclosure • The Finance department will ensure that all

data fields required under the detailed

disclosure requirement as laid down by the

regulator are being captured and no manual

intervention takes place outside of the ECL

policy and procedures.

• Ensure all relevant information pertaining to

the ECL methodology and the results are

presented to investors and various

stakeholders.

6. Internal Audit Validate ECL • Conduct periodic review and validation of the

valuation approved Internal Ratings assigned to

respective Obligors by Internal Audit

Department

• Independent validation of the ECL valuation

semi-annually

7. External Auditors Validate ECL • Semi-annual review and validation of the

valuation Internal Ratings

• Semi-annual review and validation of ECL

valuation

3.7. Reclassifications A change in intention related to

particular financial assets (even in

Financial assets are not reclassified circumstances of significant changes

subsequent to their initial recognition, except in market conditions)

in the year after the Bank changes its A temporary disappearance of a

business model for managing financial assets. particular market for financial assets.

A change in the Bank’s business model will A transfer of financial assets between

occur only when the Bank either begins or parts of the bank with different

ceases to perform an activity that is significant business models.

to its operations such as:

When reclassification occurs, the Bank

Significant internal restructuring or reclassifies all affected financial assets in

business combinations; for example, accordance with the new business model.

an acquisition of a private asset Reclassification is applied prospectively from

management company that might the ‘reclassification date’. Reclassification

necessitate transfer and sale of loans date is ‘the first day of the first reporting year

to willing buyers, this action will following the change in business model. For

constitute changes in business model example, if the Bank decides to shut down the

and subsequent reclassification of the retail business segment on 31st January

Loan held from BM1 to BM2 Category 2018, the reclassification date will be 1 April,

Disposal of a business line i.e., 2018 (i.e., the first day of the entity’s next

disposal of a business segment reporting year), the Bank shall not engage in

Any other reason that might warrant a activities consistent with its former business

change in the Bank’s business model model after 31st January 2018. Gains, losses

as determined by management based or interest previously recognised are not be

on facts and circumstances. restated when reclassification occurs.

The following are not considered to be

changes in the business model: Annual Report 2020

Guaranty Trust Bank Gambia Limited www.gtbankgambia.com 42