Page 60 - GTBANK GAMBIA ANNUAL REPORT 2021

P. 60

Contingencies currency related transactions. Contingent liabilities are

not recognized in the annual financial statements but are

Contingent assets which include transaction related disclosed in the notes to the annual financial statements

bonds and guarantees, letters of credit and short term unless they are remote.

foreign currency related transactions, are not recognized

in the annual financial statements but are disclosed when, Placements

as a result of past events, it is highly likely that economic

benefits will flow to the Bank, but this will only be The Bank has placement lines for its Bank counterparties.

confirmed by the occurrence or non-occurrence of one or The lines cover the settlement risks inherent in our

more uncertain future events which are not wholly within activities with these counterparties. The limits are arrived

the Bank’s control. at after conducting fundamental analysis of the

counterparties, presentation of findings to, and approval

Contingent liabilities include transaction related bonds by the Bank’s Management Credit Committee. The lines

and guarantees, letters of credit and short term foreign are monitored by Credit Risk Management Unit.

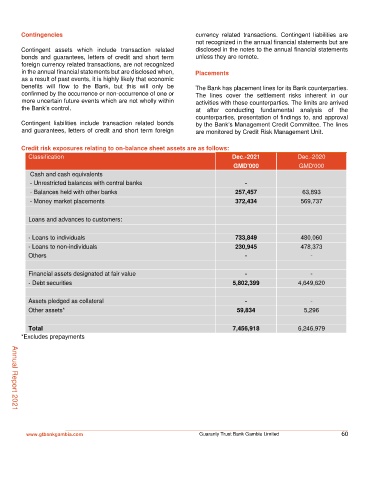

Credit risk exposures relating to on-balance sheet assets are as follows:

Classification Dec.-2021 Dec.-2020

GMD'000 GMD'000

Cash and cash equivalents

- Unrestricted balances with central banks -

- Balances held with other banks 257,457 63,893

- Money market placements 372,434 569,737

Loans and advances to customers:

- Loans to individuals 733,849 480,060

- Loans to non-individuals 230,945 478,373

Others - -

Financial assets designated at fair value - -

- Debt securities 5,802,399 4,649,620

Assets pledged as collateral - -

Other assets* 59,834 5,296

Total 7,456,918 6,246,979

*Excludes prepayments

Annual Report 2021

www.gtbankgambia.com Guaranty Trust Bank Gambia Limited 60