Page 109 - Guardian Broker Questionnaire Summary Complete Package 2 2 22_Neat

P. 109

STRICTLY CONFIDENTIAL

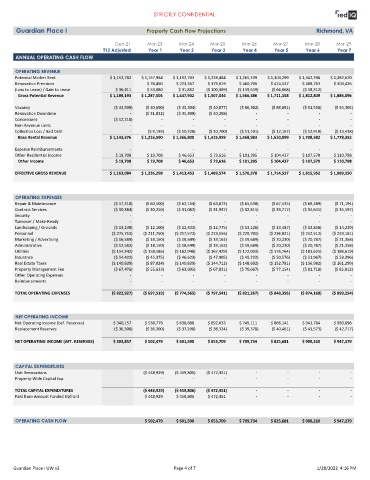

Guardian Place I Property Cash Flow Projections Richmond, VA

Dec-21 Mar-23 Mar-24 Mar-25 Mar-26 Mar-27 Mar-28 Mar-29

T12 Adjusted Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7

ANNUAL OPERATING CASH FLOW

OPERATING REVENUE

Potential Market Rent $ 1,152,782 $ 1,157,964 $ 1,192,703 $ 1,228,484 $ 1,265,339 $ 1,303,299 $ 1,342,398 $ 1,382,670

Renovation Premium $ 76,460 $ 223,367 $ 379,019 $ 460,706 $ 474,527 $ 488,763 $ 503,426

(Loss to Lease) / Gain to Lease $ 36,411 $ 53,080 $ 31,862 ($ 100,469) ($ 159,659) ($ 66,668) ($ 18,312) -

Gross Potential Revenue $ 1,189,193 $ 1,287,505 $ 1,447,932 $ 1,507,034 $ 1,566,386 $ 1,711,158 $ 1,812,849 $ 1,886,096

Vacancy ($ 33,599) ($ 30,690) ($ 35,304) ($ 40,077) ($ 86,302) ($ 88,891) ($ 91,558) ($ 94,305)

Renovation Downtime - ($ 31,032) ($ 35,499) ($ 40,298) - - - -

Concessions ($ 12,218) - - - - - - -

Non-Revenue Units - - - - - - - -

Collection Loss / Bad Debt - ($ 9,193) ($ 10,328) ($ 10,700) ($ 11,101) ($ 12,167) ($ 12,910) ($ 13,438)

Base Rental Revenue $ 1,143,376 $ 1,216,590 $ 1,366,800 $ 1,415,959 $ 1,468,983 $ 1,610,099 $ 1,708,382 $ 1,778,352

Expense Reimbursements - - - - - - - -

Other Residential Income $ 19,708 $ 19,708 $ 46,653 $ 73,616 $ 101,395 $ 104,437 $ 107,570 $ 110,798

Other Income $ 19,708 $ 19,708 $ 46,653 $ 73,616 $ 101,395 $ 104,437 $ 107,570 $ 110,798

EFFECTIVE GROSS REVENUE $ 1,163,084 $ 1,236,298 $ 1,413,453 $ 1,489,574 $ 1,570,378 $ 1,714,537 $ 1,815,952 $ 1,889,150

OPERATING EXPENSES

Repair & Maintenance ($ 57,310) ($ 60,500) ($ 62,164) ($ 63,873) ($ 65,630) ($ 67,435) ($ 69,289) ($ 71,194)

Contract Services ($ 30,384) ($ 30,250) ($ 31,082) ($ 31,937) ($ 32,815) ($ 33,717) ($ 34,645) ($ 35,597)

Security - - - - - - - -

Turnover / Make-Ready - - - - - - - -

Landscaping / Grounds ($ 13,230) ($ 12,100) ($ 12,433) ($ 12,775) ($ 13,126) ($ 13,487) ($ 13,858) ($ 14,239)

Personnel ($ 275,753) ($ 211,750) ($ 217,573) ($ 223,556) ($ 229,704) ($ 236,021) ($ 242,512) ($ 249,181)

Marketing / Advertising ($ 16,589) ($ 18,150) ($ 18,649) ($ 19,162) ($ 19,689) ($ 20,230) ($ 20,787) ($ 21,358)

Administrative ($ 12,582) ($ 18,150) ($ 18,649) ($ 19,162) ($ 19,689) ($ 20,230) ($ 20,787) ($ 21,358)

Utilities ($ 154,342) ($ 158,586) ($ 162,948) ($ 167,429) ($ 172,033) ($ 176,764) ($ 181,625) ($ 186,619)

Insurance ($ 54,422) ($ 45,375) ($ 46,623) ($ 47,905) ($ 49,222) ($ 50,576) ($ 51,967) ($ 53,396)

Real Estate Taxes ($ 140,839) ($ 87,024) ($ 140,839) ($ 144,712) ($ 148,692) ($ 152,781) ($ 156,982) ($ 161,299)

Property Management Fee ($ 67,476) ($ 55,633) ($ 63,605) ($ 67,031) ($ 70,667) ($ 77,154) ($ 81,718) ($ 85,012)

Other Operating Expenses - - - - - - - -

Reimbursements - - - - - - - -

TOTAL OPERATING EXPENSES ($ 822,927) ($ 697,519) ($ 774,565) ($ 797,541) ($ 821,267) ($ 848,395) ($ 874,168) ($ 899,254)

NET OPERATING INCOME

Net Operating Income (bef. Reserves) $ 340,157 $ 538,779 $ 638,888 $ 692,033 $ 749,111 $ 866,141 $ 941,784 $ 989,896

Replacement Reserves ($ 36,300) ($ 36,300) ($ 37,298) ($ 38,324) ($ 39,378) ($ 40,461) ($ 41,573) ($ 42,717)

NET OPERATING INCOME (AFT. RESERVES) $ 303,857 $ 502,479 $ 601,590 $ 653,709 $ 709,734 $ 825,681 $ 900,210 $ 947,179

CAPITAL EXPENDITURES

Unit Renovations ($ 448,929) ($ 459,806) ($ 472,451) - - - -

Property-Wide Capital Exp. - - - - - - -

TOTAL CAPITAL EXPENDITURES ($ 448,929) ($ 459,806) ($ 472,451) - - - -

Paid from Amount Funded Upfront $ 448,929 $ 459,806 $ 472,451 - - - -

OPERATING CASH FLOW $ 502,479 $ 601,590 $ 653,709 $ 709,734 $ 825,681 $ 900,210 $ 947,179

Guardian Place I UW v3 Page 4 of 7 1/28/2022 4:16 PM