Page 112 - Guardian Broker Questionnaire Summary Complete Package 2 2 22_Neat

P. 112

STRICTLY CONFIDENTIAL

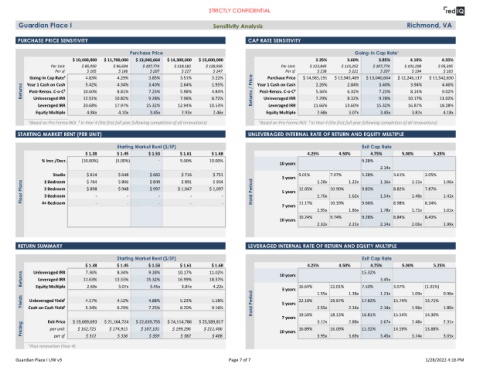

Guardian Place I Sensitivity Analysis Richmond, VA

PURCHASE PRICE SENSITIVITY CAP RATE SENSITIVITY

Purchase Price Going-In Cap Rate¹

$ 10,400,000 $ 11,700,000 $ 13,040,664 $ 14,300,000 $ 15,600,000 3.35% 3.60% 3.85% 4.10% 4.35%

Per Unit $ 85,950 $ 96,694 $ 107,774 $ 118,182 $ 128,926 Per Unit $ 123,845 $ 115,252 $ 107,774 $ 101,208 $ 95,395

Per sf $ 165 $ 186 $ 207 $ 227 $ 247 Per sf $ 238 $ 221 $ 207 $ 194 $ 183

Going-In Cap Rate¹ 4.83% 4.29% 3.85% 3.51% 3.22% Purchase Price $ 14,985,191 $ 13,945,469 $ 13,040,664 $ 12,246,117 $ 11,542,830

Returns Year 1 Cash on Cash 10.60% 10.82% 3.40% 2.64% 1.95% Returns / Price Year 1 Cash on Cash 2.26% 2.84% 3.40% 10.17% 11.02%

4.46%

4.34%

5.42%

3.94%

Post-Renov. C-o-C²

8.81%

9.02%

Post-Renov. C-o-C²

8.14%

6.32%

5.98%

4.84%

7.25%

7.25%

5.36%

12.51%

7.96%

9.28%

Unleveraged IRR

8.32%

7.29%

9.28%

Unleveraged IRR

6.72%

Leveraged IRR 20.68% 17.97% 15.32% 12.94% 10.53% Leveraged IRR 11.66% 13.60% 15.32% 16.87% 18.28%

Equity Multiple 4.84x 4.10x 3.45x 2.93x 2.46x Equity Multiple 2.68x 3.07x 3.45x 3.82x 4.18x

¹ Based on Pro Forma NOI ² In Year 4 (the first full year following completion of all renovations) ¹ Based on Pro Forma NOI ² In Year 4 (the first full year following completion of all renovations)

STARTING MARKET RENT (PER UNIT) UNLEVERAGED INTERNAL RATE OF RETURN AND EQUITY MULTIPLE

Starting Market Rent ($/SF) Exit Cap Rate

$ 1.38 $ 1.45 $ 1.53 $ 1.61 $ 1.68 4.25% 4.50% 4.75% 5.00% 5.25%

% Incr./Decr. (10.00%) (5.00%) - 5.00% 10.00% 9.28%

10 years

2.14x

Studio $ 614 $ 648 $ 682 $ 716 $ 751 3 years 9.01% 1.28x 7.07% 1.22x 5.28% 1.16x 3.61% 1.11x 2.05% 1.06x

$ 849

Floor Plans 2 Bedroom $ 898 - $ 948 - $ 997 - $ 1,047 - $ 1,097 - Hold Period 5 years 12.05% 1.70x 10.90% 1.62x 9.83% 1.54x 8.82% 1.48x 7.87% 1.42x

1 Bedroom

$ 806

$ 934

$ 764

$ 891

3 Bedroom

-

-

-

-

4+ Bedroom

-

7 years 11.17% 10.39% 9.66% 8.98% 8.34%

1.95x 1.86x 1.78x 1.71x 1.65x

10.24% 9.74% 9.28% 8.84% 8.43%

10 years

2.32x 2.22x 2.14x 2.06x 1.99x

RETURN SUMMARY LEVERAGED INTERNAL RATE OF RETURN AND EQUITY MULTIPLE

Starting Market Rent ($/SF) Exit Cap Rate

$ 1.38 $ 1.45 $ 1.53 $ 1.61 $ 1.68 4.25% 4.50% 4.75% 5.00% 5.25%

Returns Unleveraged IRR 11.63% 13.55% 15.32% 10.17% 11.02% 10 years 16.64% 12.01% 15.32% 3.45x 3.07% (1.31%)

7.36%

8.34%

9.28%

18.57%

16.99%

Leveraged IRR

4.22x

Equity Multiple

2.69x

3.07x

7.50%

3.45x

3.84x

3 years

Yields Cash on Cash Yield¹ 4.17% 4.52% 4.88% 5.23% 5.58% Hold Period 5 years 22.19% 1.55x 19.97% 1.38x 17.82% 1.23x 15.74% 1.09x 13.71% 0.96x

Unleveraged Yield¹

1.96x

1.80x

8.20%

2.34x

2.14x

2.55x

6.29%

7.25%

9.16%

5.34%

7 years 19.50% 3.12x 18.13% 2.88x 16.81% 2.67x 15.54% 2.48x 14.30% 2.31x

$ 21,164,724

$ 22,639,755

Exit Price

$ 19,689,693

$ 25,589,817

$ 24,114,786

Pricing per unit $ 162,725 $ 174,915 $ 187,105 $ 199,296 $ 211,486 10 years 16.89% 3.95x 16.09% 3.69x 15.32% 3.45x 14.59% 3.24x 13.88% 3.05x

per sf

$ 406

$ 359

$ 336

$ 382

$ 312

¹ Post renovation (Year 4)

Guardian Place I UW v3 Page 7 of 7 1/28/2022 4:16 PM