Page 117 - Guardian Broker Questionnaire Summary Complete Package 2 2 22_Neat

P. 117

STRICTLY CONFIDENTIAL

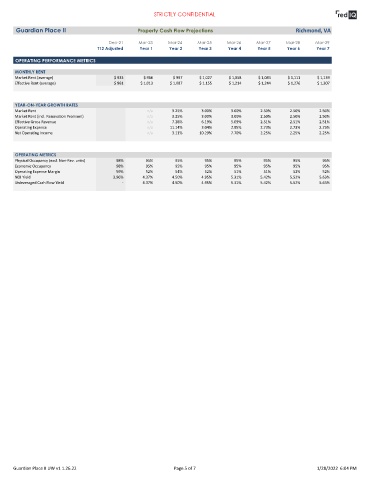

Guardian Place II Property Cash Flow Projections Richmond, VA

Dec-21 Mar-23 Mar-24 Mar-25 Mar-26 Mar-27 Mar-28 Mar-29

T12 Adjusted Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7

OPERATING PERFORMANCE METRICS

MONTHLY RENT

Market Rent (average) $ 933 $ 966 $ 997 $ 1,027 $ 1,058 $ 1,084 $ 1,111 $ 1,139

Effective Rent (average) $ 961 $ 1,013 $ 1,087 $ 1,155 $ 1,214 $ 1,244 $ 1,276 $ 1,307

YEAR-ON-YEAR GROWTH RATES

Market Rent n/a 3.25% 3.00% 3.00% 2.50% 2.50% 2.50%

Market Rent (incl. Renovation Premium) n/a 3.25% 3.00% 3.00% 2.50% 2.50% 2.50%

Effective Gross Revenue n/a 7.28% 6.19% 5.09% 2.51% 2.51% 2.51%

Operating Expense n/a 11.14% 3.04% 2.95% 2.73% 2.73% 2.73%

Net Operating Income n/a 3.11% 10.29% 7.70% 2.25% 2.25% 2.25%

OPERATING METRICS

Physical Occupancy (excl. Non-Rev. units) 98% 95% 95% 95% 95% 95% 95% 95%

Economic Occupancy 98% 95% 95% 95% 95% 95% 95% 95%

Operating Expense Margin 59% 52% 54% 52% 51% 51% 52% 52%

NOI Yield 3.96% 4.37% 4.50% 4.95% 5.31% 5.42% 5.52% 5.63%

Unleveraged Cash Flow Yield - 4.37% 4.50% 4.95% 5.31% 5.42% 5.52% 5.63%

Guardian Place II UW v1 1.26.22 Page 5 of 7 1/28/2022 6:04 PM