Page 119 - Guardian Broker Questionnaire Summary Complete Package 2 2 22_Neat

P. 119

STRICTLY CONFIDENTIAL

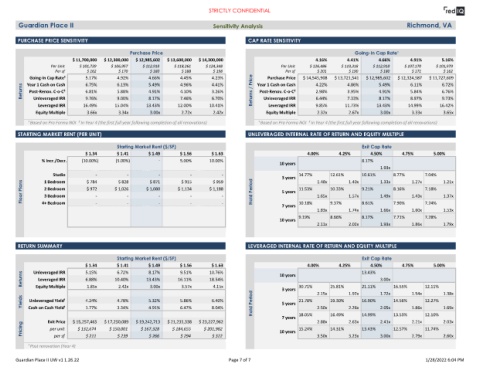

Guardian Place II Sensitivity Analysis Richmond, VA

PURCHASE PRICE SENSITIVITY CAP RATE SENSITIVITY

Purchase Price Going-In Cap Rate¹

$ 11,700,000 $ 12,300,000 $ 12,985,602 $ 13,600,000 $ 14,300,000 4.16% 4.41% 4.66% 4.91% 5.16%

Per Unit $ 101,739 $ 106,957 $ 112,918 $ 118,261 $ 124,348 Per Unit $ 126,486 $ 119,318 $ 112,918 $ 107,170 $ 101,979

Per sf $ 162 $ 170 $ 180 $ 188 $ 198 Per sf $ 201 $ 190 $ 180 $ 171 $ 162

Going-In Cap Rate¹ 5.17% 4.92% 4.66% 4.45% 4.23% Purchase Price $ 14,545,908 $ 13,721,541 $ 12,985,602 $ 12,324,587 $ 11,727,609

Returns Year 1 Cash on Cash 6.75% 6.13% 5.49% 4.96% 4.41% Returns / Price Year 1 Cash on Cash 4.22% 4.86% 5.49% 6.11% 6.72%

5.88%

5.84%

6.81%

3.26%

Post-Renov. C-o-C²

2.98%

3.95%

4.91%

4.91%

4.10%

Post-Renov. C-o-C²

6.76%

9.73%

8.17%

9.76%

9.00%

6.70%

Unleveraged IRR

6.44%

8.17%

7.46%

7.33%

8.97%

Unleveraged IRR

Leveraged IRR 16.49% 15.04% 13.43% 12.00% 10.41% Leveraged IRR 9.85% 11.73% 13.43% 14.99% 16.42%

Equity Multiple 3.66x 3.34x 3.00x 2.72x 2.42x Equity Multiple 2.32x 2.67x 3.00x 3.33x 3.65x

¹ Based on Pro Forma NOI ² In Year 4 (the first full year following completion of all renovations) ¹ Based on Pro Forma NOI ² In Year 4 (the first full year following completion of all renovations)

STARTING MARKET RENT (PER UNIT) UNLEVERAGED INTERNAL RATE OF RETURN AND EQUITY MULTIPLE

Starting Market Rent ($/SF) Exit Cap Rate

$ 1.34 $ 1.41 $ 1.49 $ 1.56 $ 1.63 4.00% 4.25% 4.50% 4.75% 5.00%

% Incr./Decr. (10.00%) (5.00%) - 5.00% 10.00% 8.17%

10 years

1.93x

Studio $ 784 - $ 828 - $ 871 - $ 915 - $ 959 - 3 years 14.77% 1.48x 12.61% 1.40x 10.61% 1.33x 8.77% 1.27x 7.04% 1.21x

1 Bedroom

Floor Plans 2 Bedroom $ 972 - $ 1,026 - $ 1,080 - $ 1,134 - $ 1,188 - Hold Period 5 years 11.53% 1.65x 10.33% 1.57x 9.21% 1.49x 8.16% 1.43x 7.18% 1.37x

3 Bedroom

4+ Bedroom

-

-

-

-

-

7 years 10.18% 9.37% 8.61% 7.90% 7.24%

1.83x 1.74x 1.66x 1.60x 1.53x

9.19% 8.66% 8.17% 7.71% 7.28%

10 years

2.11x 2.02x 1.93x 1.86x 1.79x

RETURN SUMMARY LEVERAGED INTERNAL RATE OF RETURN AND EQUITY MULTIPLE

Starting Market Rent ($/SF) Exit Cap Rate

$ 1.34 $ 1.41 $ 1.49 $ 1.56 $ 1.63 4.00% 4.25% 4.50% 4.75% 5.00%

Returns Unleveraged IRR 5.15% 10.40% 13.43% 16.11% 10.76% 10 years 30.71% 25.81% 13.43% 3.00x 16.55% 12.11%

9.51%

6.72%

8.17%

18.54%

6.88%

Leveraged IRR

3.00x

4.15x

Equity Multiple

2.42x

21.11%

1.85x

3.57x

3 years

Yields Cash on Cash Yield¹ 4.24% 4.78% 5.32% 5.86% 6.40% Hold Period 5 years 21.78% 2.15x 19.30% 1.92x 16.90% 1.72x 14.56% 1.54x 12.27% 1.38x

Unleveraged Yield¹

1.69x

1.86x

4.91%

3.34%

1.77%

2.05x

8.04%

2.50x

6.47%

2.26x

7 years 18.05% 2.88x 16.49% 2.63x 14.99% 2.41x 13.53% 2.21x 12.10% 2.03x

$ 17,250,089

$ 19,242,713

Exit Price

$ 15,257,465

$ 23,227,962

$ 21,235,338

Pricing per unit $ 132,674 $ 150,001 $ 167,328 $ 184,655 $ 201,982 10 years 15.24% 3.50x 14.31% 3.23x 13.43% 3.00x 12.57% 2.79x 11.74% 2.60x

per sf

$ 322

$ 266

$ 239

$ 294

$ 211

¹ Post renovation (Year 4)

Guardian Place II UW v1 1.26.22 Page 7 of 7 1/28/2022 6:04 PM