Page 115 - Guardian Broker Questionnaire Summary Complete Package 2 2 22_Neat

P. 115

STRICTLY CONFIDENTIAL

Guardian Place II Historical Operating Statements Richmond, VA

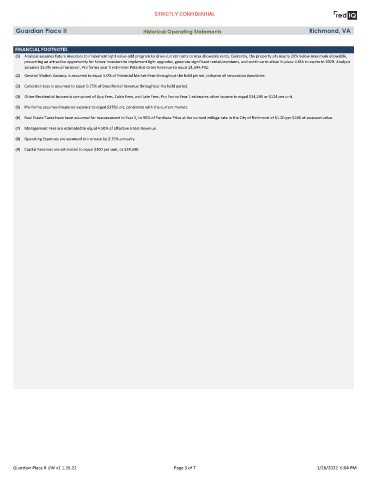

FINANCIAL FOOTNOTES

(1) Analysis assumes future investors to implement light value-add program to drive current rents to max allowable rents. Currently, the property sits nearly 20% below maximum allowable,

presenting an attractive opportunity for future investors to implement light upgrades, generate significant rental premiums, and continue to allow in-place LURA to expire in 2029. Analysis

assumes 25.0% annual turnover, Pro forma year 1 estimates Potential Gross Revenue to equal $1,394,492.

(2) General Market Vacancy is assumed to equal 5.0% of Potential Market Rent throughout the hold period ,inclusive of renovation downtime.

(3) Collection Loss is assumed to equal 0.75% of Base Rental Revenue throughout the hold period.

(4) Other Residential Income is comprised of App Fees, Cable Fees, and Late Fees. Pro Forma Year 1 estimates other income to equal $14,245 or $124 per unit.

(5) Pro forma assumes Insurance expense to equal $375/unit, consistent with the current market.

(6) Real Estate Taxes have been assumed for reassessment in Year 2, to 90% of Purchase Price at the current millage rate in the City of Richmond of $1.20 per $100 of assessed value.

(7) Management Fees are estimated to equal 4.50% of Effective Gross Revenue.

(8) Operating Expenses are assumed to increase by 2.75% annually.

(9) Capital Reserves are estimated to equal $300 per unit, or $34,500.

Guardian Place II UW v1 1.26.22 Page 3 of 7 1/28/2022 6:04 PM