Page 32 - Guardian Broker Questionnaire Summary Complete Package 2 2 22_Neat

P. 32

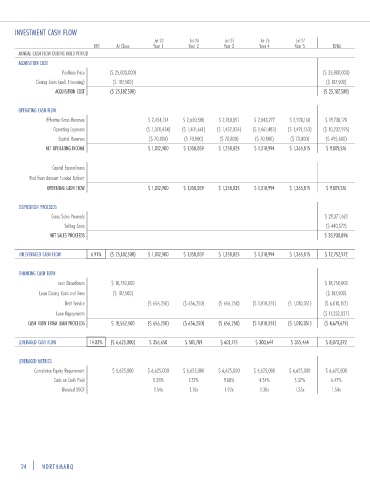

INVESTMENT CASH FLOW

Jul-23 Jul-24 Jul-25 Jul-26 Jul-27

IRR At Close Year 1 Year 2 Year 3 Year 4 Year 5 TOTAL

ANNUAL CASH FLOW DURING HOLD PERIOD

ACQUISITION COST

Purchase Price ($ 25,000,000) ($ 25,000,000)

Closing Costs (excl. Financing) ($ 187,500) ($ 187,500)

ACQUISITION COST ($ 25,187,500) ($ 25,187,500)

OPERATING CASH FLOW

Effective Gross Revenue $ 2,454,134 $ 2,630,500 $ 2,760,851 $ 2,843,277 $ 2,928,168 $ 19,738,170

Operating Expenses ($ 1,370,434) ($ 1,401,661) ($ 1,432,026) ($ 1,461,483) ($ 1,491,553) ($ 10,232,995)

Capital Reserves ($ 70,800) ($ 70,800) ($ 70,800) ($ 70,800) ($ 70,800) ($ 495,600)

NET OPERATING INCOME $ 1,012,900 $ 1,158,039 $ 1,258,025 $ 1,310,994 $ 1,365,815 $ 9,009,576

Capital Expenditures

Paid from Amount Funded Upfront

OPERATING CASH FLOW $ 1,012,900 $ 1,158,039 $ 1,258,025 $ 1,310,994 $ 1,365,815 $ 9,009,576

DISPOSITION PROCEEDS

Gross Sales Proceeds $ 29,371,468

Selling Costs ($ 440,572)

NET SALES PROCEEDS $ 28,930,896

UNLEVERAGED CASH FLOW 6.91% ($ 25,187,500) $ 1,012,900 $ 1,158,039 $ 1,258,025 $ 1,310,994 $ 1,365,815 $ 12,752,972

FINANCING CASH FLOW

Loan Drawdowns $ 18,750,000 $ 18,750,000

Loan Closing Costs and Fees ($ 187,500) ($ 187,500)

Debt Service ($ 656,250) ($ 656,250) ($ 656,250) ($ 1,010,351) ($ 1,010,351) ($ 6,010,152)

Loan Repayments ($ 17,232,027)

CASH FLOW FROM LOAN PROCEEDS $ 18,562,500 ($ 656,250) ($ 656,250) ($ 656,250) ($ 1,010,351) ($ 1,010,351) ($ 4,679,679)

LEVERAGED CASH FLOW 14.03% ($ 6,625,000) $ 356,650 $ 501,789 $ 601,775 $ 300,644 $ 355,464 $ 8,073,292

LEVERAGED METRICS

Cumulative Equity Requirement $ 6,625,000 $ 6,625,000 $ 6,625,000 $ 6,625,000 $ 6,625,000 $ 6,625,000 $ 6,625,000

Cash on Cash Yield 5.38% 7.57% 9.08% 4.54% 5.37% 6.47%

Blended DSCR 1.54x 1.76x 1.92x 1.30x 1.35x 1.54x

24 | NORTHMARQ