Page 41 - Annual Report 2016 - Cover & Divider Pages.indd

P. 41

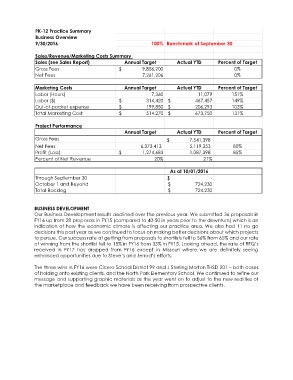

PK-12 Practice Summary

Business Overview

9/30/2016 100% Benchmark at September 30

Sales/Revenue/Marketing Costs Summary

Sales (see Sales Report) Annual Target Actual YTD Percent of Target

Gross Fees $ 9,856,200 0%

Net Fees 7,261,206 0%

Marketing Costs Annual Target Actual YTD Percent of Target

Labor (Hours) 7,360 11,079 151%

Labor ($) $ 314,420 $ 467,457 149%

Out-of-pocket expense $ 199,850 $ 206,293 103%

Total Marketing Cost $ 514,270 $ 673,750 131%

Project Performance

Annual Target Actual YTD Percent of Target

Gross Fees $ 7,541,398

Net Fees 6,373,413 5,119,353 80%

Profit (Loss) $ 1,274,683 1,087,398 85%

Percent of Net Revenue 20% 21%

As at 10/01/2016

Through September 30 $ -

October 1 and Beyond $ 724,230

Total Backlog $ 724,230

BUSINESS DEVELOPMENT

Our Business Development results declined over the previous year. We submitted 36 proposals in

FY16 up from 28 proposals in FY15 (compared to 40-50 in years prior to the downturn) which is an

indication of how the economic climate is affecting our practice area. We also had 11 no go

decisions this past year as we continued to focus on making better decisions about which projects

to pursue. Our success rate at getting from proposals to shortlists fell to 56% from 65% and our rate

of winning from the shortlist fell to 15% in FY16 from 33% in FY15. Looking ahead, the rate of RFQ’s

received in FY17 has dropped from FY16 except in Missouri where we are definitely seeing

enhanced opportunities due to Steve’s and Jerrod’s efforts.

The three wins in FY16 were Cicero School District 99 and J Sterling Morton THSD 201 – both cases

of holding onto existing clients, and the North Park Elementary School. We continued to refine our

message and supporting graphic materials as the year went on to adjust to the new realities of

the marketplace and feedback we have been receiving from prospective clients.