Page 197 - 2024 Orientation Manual

P. 197

The S&P 500 Stock Index (and other appropriate stock indices) to determine

volatility, security selection and performance;

The results of comparable equity funds as measured by a recognized third

party consultant with expectations of upper half performance over a three-

year period (style specific universes and indices will be used);

The Committee’s desire is that the Fund’s performance place in the upper

third of a comparable universe of funds during falling or down markets.

D. For the Fixed Income Portion of the Fund

The performance of the fixed income portion of the portfolio will be compared

with the following:

The Salomon Bros. 3-7 Year Government/Corporate Index to determine

volatility, security selection and performance;

The results of comparable fixed income funds as measured by a recognized

third party consultant with expectations of upper half performance over a

rolling three-year period (style specific universes and indices will be used);

The Committee’s desire is the Fund’s performance place in the upper third

of a comparable universe of funds during falling or down markets.

E. For the Cash Equivalent Portion of the Fund

The performance of the cash equivalent portion of the portfolio will be

compared with 90-day U.S. Treasury Bill yields and the Consumer Price Index.

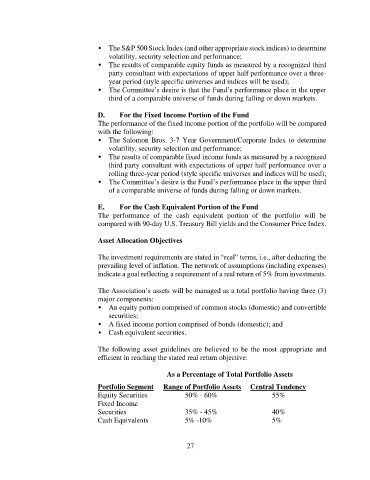

Asset Allocation Objectives

The investment requirements are stated in “real” terms, i.e., after deducting the

prevailing level of inflation. The network of assumptions (including expenses)

indicate a goal reflecting a requirement of a real return of 5% from investments.

The Association’s assets will be managed as a total portfolio having three (3)

major components:

An equity portion comprised of common stocks (domestic) and convertible

securities;

A fixed income portion comprised of bonds (domestic); and

Cash equivalent securities.

The following asset guidelines are believed to be the most appropriate and

efficient in reaching the stated real return objective:

As a Percentage of Total Portfolio Assets

Portfolio Segment Range of Portfolio Assets Central Tendency

Equity Securities 50% - 60% 55%

Fixed Income

Securities 35% - 45% 40%

Cash Equivalents 5% -10% 5%

27