Page 195 - 2024 Orientation Manual

P. 195

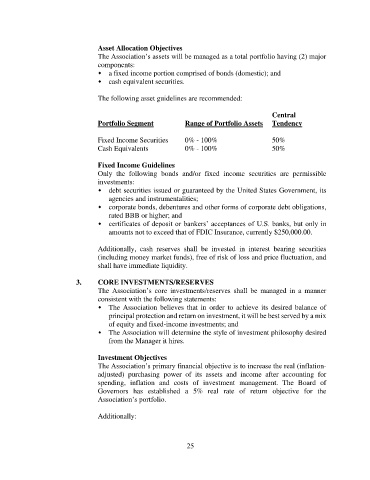

Asset Allocation Objectives

The Association’s assets will be managed as a total portfolio having (2) major

components:

a fixed income portion comprised of bonds (domestic); and

cash equivalent securities.

The following asset guidelines are recommended:

Central

Portfolio Segment Range of Portfolio Assets Tendency

Fixed Income Securities 0% - 100% 50%

Cash Equivalents 0% - 100% 50%

Fixed Income Guidelines

Only the following bonds and/or fixed income securities are permissible

investments:

debt securities issued or guaranteed by the United States Government, its

agencies and instrumentalities;

corporate bonds, debentures and other forms of corporate debt obligations,

rated BBB or higher; and

certificates of deposit or bankers’ acceptances of U.S. banks, but only in

amounts not to exceed that of FDIC Insurance, currently $250,000.00.

Additionally, cash reserves shall be invested in interest bearing securities

(including money market funds), free of risk of loss and price fluctuation, and

shall have immediate liquidity.

3. CORE INVESTMENTS/RESERVES

The Association’s core investments/reserves shall be managed in a manner

consistent with the following statements:

The Association believes that in order to achieve its desired balance of

principal protection and return on investment, it will be best served by a mix

of equity and fixed-income investments; and

The Association will determine the style of investment philosophy desired

from the Manager it hires.

Investment Objectives

The Association’s primary financial objective is to increase the real (inflation-

adjusted) purchasing power of its assets and income after accounting for

spending, inflation and costs of investment management. The Board of

Governors has established a 5% real rate of return objective for the

Association’s portfolio.

Additionally:

25