Page 240 - 2024 Orientation Manual

P. 240

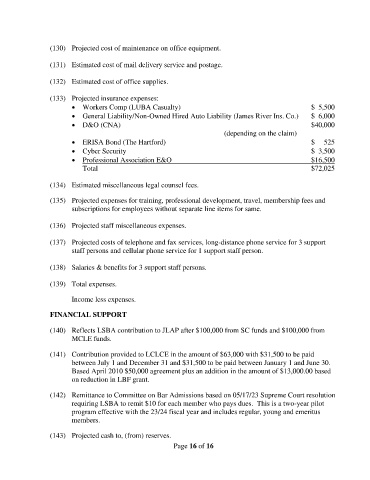

(130) Projected cost of maintenance on office equipment.

(131) Estimated cost of mail delivery service and postage.

(132) Estimated cost of office supplies.

(133) Projected insurance expenses:

• Workers Comp (LUBA Casualty) $ 5,500

• General Liability/Non-Owned Hired Auto Liability (James River Ins. Co.) $ 6,000

• D&O (CNA) $40,000

(depending on the claim)

• ERISA Bond (The Hartford) $ 525

• Cyber Security $ 3,500

• Professional Association E&O $16,500

Total $72,025

(134) Estimated miscellaneous legal counsel fees.

(135) Projected expenses for training, professional development, travel, membership fees and

subscriptions for employees without separate line items for same.

(136) Projected staff miscellaneous expenses.

(137) Projected costs of telephone and fax services, long-distance phone service for 3 support

staff persons and cellular phone service for 1 support staff person.

(138) Salaries & benefits for 3 support staff persons.

(139) Total expenses.

Income less expenses.

FINANCIAL SUPPORT

(140) Reflects LSBA contribution to JLAP after $100,000 from SC funds and $100,000 from

MCLE funds.

(141) Contribution provided to LCLCE in the amount of $63,000 with $31,500 to be paid

between July 1 and December 31 and $31,500 to be paid between January 1 and June 30.

Based April 2010 $50,000 agreement plus an addition in the amount of $13,000.00 based

on reduction in LBF grant.

(142) Remittance to Committee on Bar Admissions based on 05/17/23 Supreme Court resolution

requiring LSBA to remit $10 for each member who pays dues. This is a two-year pilot

program effective with the 23/24 fiscal year and includes regular, young and emeritus

members.

(143) Projected cash to, (from) reserves.

Page 16 of 16