Page 66 - Financial Statement Analysis

P. 66

sub79433_ch01.qxd 4/18/08 11:10 AM Page 43

Chapter One | Overview of Financial Statement Analysis 43

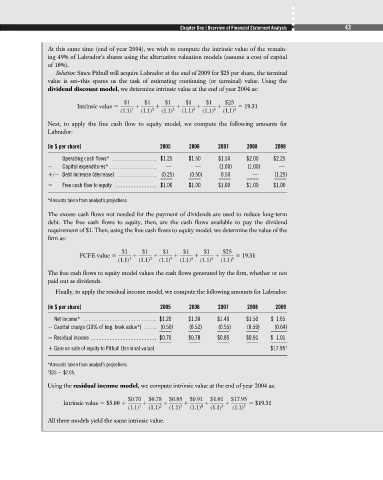

At this same time (end of year 2004), we wish to compute the intrinsic value of the remain-

ing 49% of Labrador’s shares using the alternative valuation models (assume a cost of capital

of 10%).

Solution: Since Pitbull will acquire Labrador at the end of 2009 for $25 per share, the terminal

value is set—this spares us the task of estimating continuing (or terminal) value. Using the

dividend discount model, we determine intrinsic value at the end of year 2004 as:

$1 $1 $1 $1 $1 $25

Intrinsic value 19.31

(1.1) 1 (1.1) 2 (1.1) 3 (1.1) 4 (1.1) 5 (1.1) 5

Next, to apply the free cash flow to equity model, we compute the following amounts for

Labrador:

(in $ per share) 2005 2006 2007 2008 2009

Operating cash flows* . . . . . . . . . . . . . . . . . $1.25 $1.50 $1.50 $2.00 $2.25

Capital expenditures* . . . . . . . . . . . . . . . . . . — — (1.00) (1.00) —

Debt increase (decrease) . . . . . . . . . . . . . . . (0.25) (0.50) 0.50 — (1.25)

Free cash flow to equity . . . . . . . . . . . . . . . . $1.00 $1.00 $1.00 $1.00 $1.00

*Amounts taken from analyst’s projections.

The excess cash flows not needed for the payment of dividends are used to reduce long-term

debt. The free cash flows to equity, then, are the cash flows available to pay the dividend

requirement of $1. Then, using the free cash flows to equity model, we determine the value of the

firm as:

$1 $1 $1 $1 $1 $25

FCFE value 19.31

(1.1) 1 (1.1) 2 (1.1) 3 (1.1) 4 (1.1) 5 (1.1) 5

The free cash flows to equity model values the cash flows generated by the firm, whether or not

paid out as dividends.

Finally, to apply the residual income model, we compute the following amounts for Labrador:

(in $ per share) 2005 2006 2007 2008 2009

Net income* . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1.20 $1.30 $1.40 $1.50 $ 1.65

Capital charge (10% of beg. book value*) . . . . . (0.50) (0.52) (0.55) (0.59) (0.64)

Residual income . . . . . . . . . . . . . . . . . . . . . . . . . $0.70 $0.78 $0.85 $0.91 $ 1.01

Gain on sale of equity to Pitbull (terminal value) $17.95 †

*Amounts taken from analyst’s projections.

† $25 $7.05.

Using the residual income model, we compute intrinsic value at the end of year 2004 as:

$0.70 $0.78 $0.85 $0.91 $1.01 $17.95

Intrinsic value $5.00 $19.31

(1.1) 1 (1.1) 2 (1.1) 3 (1.1) 4 (1.1) 5 (1.1) 5

All three models yield the same intrinsic value.