Page 69 - Financial Statement Analysis

P. 69

sub79433_ch01.qxd 4/7/08 3:27 PM Page 46

46 Financial Statement Analysis

Warren Buffett expresses amazement that EMH is still embraced by some scholars and

analysts. This, Buffett maintains, is because by observing correctly that the market is fre-

quently efficient, they conclude incorrectly it is always efficient. Buffett declares, “the dif-

ference between these propositions is night and day.”

Analysis Research

TIT ANIC EFFICIENCY

If the market’s reaction to the sink- International Mercantile Marine market-adjusted returns on IMM’s

ing of the Titanic in 1912 is any (IMM) that was traded on the stock (covering the day the news of

guide, investors were pretty sharp NYSE. The ship cost $7.5 million the tragedy broke and the day after)

even in the pre-“efficient market” and was insured by Lloyd’s for reflect a decline of $2.6 million in the

era. The Titanic was owned by $5 million, so the net loss to IMM value of IMM—uncannily close to

White Star Line, a subsidiary of was about $2.5 million. The two-day the $2.5 million actual net loss.

Source: BusinessWeek (1998)

BOOK ORGANIZA TION

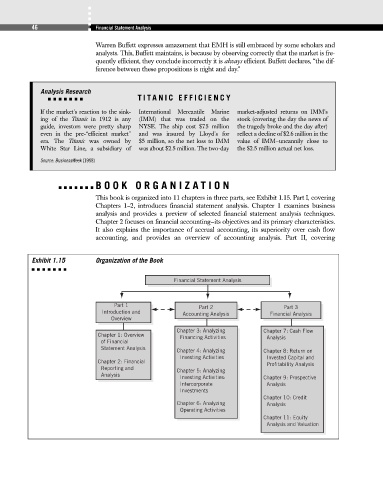

This book is organized into 11 chapters in three parts, see Exhibit 1.15. Part I, covering

Chapters 1–2, introduces financial statement analysis. Chapter 1 examines business

analysis and provides a preview of selected financial statement analysis techniques.

Chapter 2 focuses on financial accounting—its objectives and its primary characteristics.

It also explains the importance of accrual accounting, its superiority over cash flow

accounting, and provides an overview of accounting analysis. Part II, covering

Exhibit 1.15 Organization of the Book

Financial Statement Analysis

Part 1

Part 2 Part 3

Introduction and

Accounting Analysis Financial Analysis

Overview

Chapter 3: Analyzing Chapter 7: Cash Flow

Chapter 1: Overview Financing Activities Analysis

of Financial

Statement Analysis

Chapter 4: Analyzing Chapter 8: Return on

Investing Activities Invested Capital and

Chapter 2: Financial Profitability Analysis

Reporting and Chapter 5: Analyzing

Analysis

Investing Activities: Chapter 9: Prospective

Intercorporate Analysis

Investments

Chapter 10: Credit

Chapter 6: Analyzing Analysis

Operating Activities

Chapter 11: Equity

Analysis and Valuation