Page 74 - Financial Statement Analysis

P. 74

sub79433_ch01.qxd 4/7/08 11:21 AM Page 51

Chapter One | Overview of Financial Statement Analysis 51

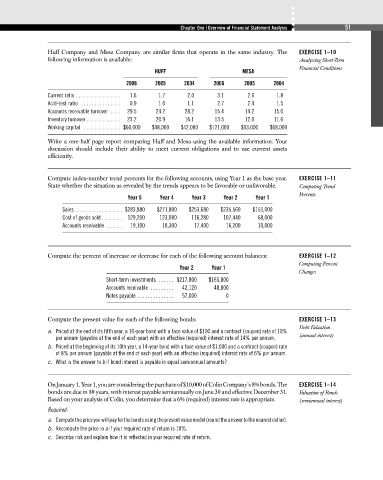

Huff Company and Mesa Company are similar firms that operate in the same industry. The EXERCISE 1–10

following information is available: Analyzing Short-Term

Financial Conditions

HUFF MESA

2006 2005 2004 2006 2005 2004

Current ratio . . . . . . . . . . . . . . . . . 1.6 1.7 2.0 3.1 2.6 1.8

Acid-test ratio . . . . . . . . . . . . . . . 0.9 1.0 1.1 2.7 2.4 1.5

Accounts receivable turnover . . . . 29.5 24.2 28.2 15.4 14.2 15.0

Inventory turnover . . . . . . . . . . . . . 23.2 20.9 16.1 13.5 12.0 11.6

Working capital . . . . . . . . . . . . . . $60,000 $48,000 $42,000 $121,000 $93,000 $68,000

Write a one-half page report comparing Huff and Mesa using the available information. Your

discussion should include their ability to meet current obligations and to use current assets

efficiently.

Compute index-number trend percents for the following accounts, using Year 1 as the base year. EXERCISE 1–11

State whether the situation as revealed by the trends appears to be favorable or unfavorable. Computing Trend

Percents

Year 5 Year 4 Year 3 Year 2 Year 1

Sales . . . . . . . . . . . . . . . . . . $283,880 $271,800 $253,680 $235,560 $151,000

Cost of goods sold . . . . . . . . 129,200 123,080 116,280 107,440 68,000

Accounts receivable . . . . . . 19,100 18,300 17,400 16,200 10,000

Compute the percent of increase or decrease for each of the following account balances: EXERCISE 1–12

Computing Percent

Year 2 Year 1

Changes

Short-term investments . . . . . . $217,800 $165,000

Accounts receivable . . . . . . . . . 42,120 48,000

Notes payable . . . . . . . . . . . . . . 57,000 0

Compute the present value for each of the following bonds: EXERCISE 1–13

Debt Valuation

a. Priced at the end of its fifth year, a 10-year bond with a face value of $100 and a contract (coupon) rate of 10%

per annum (payable at the end of each year) with an effective (required) interest rate of 14% per annum. (annual interest)

b. Priced at the beginning of its 10th year, a 14-year bond with a face value of $1,000 and a contract (coupon) rate

of 8% per annum (payable at the end of each year) with an effective (required) interest rate of 6% per annum.

c. What is the answer to b if bond interest is payable in equal semiannual amounts?

On January 1, Year 1, you are considering the purchase of $10,000 of Colin Company’s 8% bonds. The EXERCISE 1–14

bonds are due in 10 years, with interest payable semiannually on June 30 and effective December 31. Valuation of Bonds

Based on your analysis of Colin, you determine that a 6% (required) interest rate is appropriate. (semiannual interest)

Required:

a. Computethepriceyouwillpayforthebondsusingthepresentvaluemodel(roundtheanswertothenearestdollar).

b. Recompute the price in a if your required rate of return is 10%.

c. Describe risk and explain how it is reflected in your required rate of return.