Page 76 - Financial Statement Analysis

P. 76

sub79433_ch01.qxd 4/7/08 11:21 AM Page 53

Chapter One | Overview of Financial Statement Analysis 53

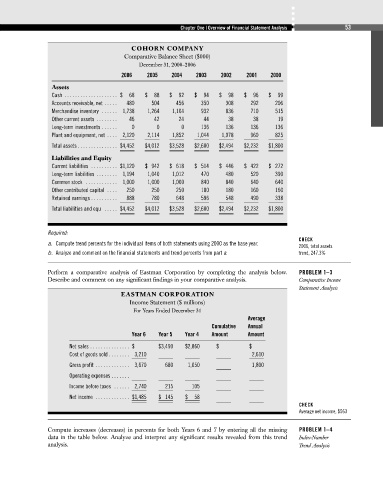

COHORN COMPANY

Comparative Balance Sheet ($000)

December 31, 2000–2006

2006 2005 2004 2003 2002 2001 2000

Assets

Cash . . . . . . . . . . . . . . . . . . . . $ 68 $ 88 $ 92 $ 94 $ 98 $ 96 $ 99

Accounts receivable, net . . . . . 480 504 456 350 308 292 206

Merchandise inventory . . . . . . 1,738 1,264 1,104 932 836 710 515

Other current assets . . . . . . . . 46 42 24 44 38 38 19

Long-term investments . . . . . . 0 0 0 136 136 136 136

Plant and equipment, net . . . . 2,120 2,114 1,852 1,044 1,078 960 825

Total assets . . . . . . . . . . . . . . . $4,452 $4,012 $3,528 $2,600 $2,494 $2,232 $1,800

Liabilities and Equity

Current liabilities . . . . . . . . . . $1,120 $ 942 $ 618 $ 514 $ 446 $ 422 $ 272

Long-term liabilities . . . . . . . . 1,194 1,040 1,012 470 480 520 390

Common stock . . . . . . . . . . . . 1,000 1,000 1,000 840 840 640 640

Other contributed capital . . . . 250 250 250 180 180 160 160

Retained earnings . . . . . . . . . . 888 780 648 596 548 490 338

Total liabilities and equ . . . . . $4,452 $4,012 $3,528 $2,600 $2,494 $2,232 $1,800

Required:

CHECK

a. Compute trend percents for the individual items of both statements using 2000 as the base year.

2006, total assets

b. Analyze and comment on the financial statements and trend percents from part a. trend, 247.3%

Perform a comparative analysis of Eastman Corporation by completing the analysis below. PROBLEM 1–3

Describe and comment on any significant findings in your comparative analysis. Comparative Income

Statement Analysis

EASTMAN CORPORATION

Income Statement ($ millions)

For Years Ended December 31

Average

Cumulative Annual

Year 6 Year 5 Year 4 Amount Amount

Net sales . . . . . . . . . . . . . . . $ $3,490 $2,860 $ $

Cost of goods sold . . . . . . . . 3,210 2,610

Gross profit . . . . . . . . . . . . . 3,670 680 1,050 1,800

Operating expenses . . . . . . .

Income before taxes . . . . . . 2,740 215 105

Net income . . . . . . . . . . . . . $1,485 $ 145 $ 58

CHECK

Average net income, $563

Compute increases (decreases) in percents for both Years 6 and 7 by entering all the missing PROBLEM 1–4

data in the table below. Analyze and interpret any significant results revealed from this trend Index-Number

analysis. Trend Analysis