Page 75 - Financial Statement Analysis

P. 75

sub79433_ch01.qxd 4/7/08 11:21 AM Page 52

52 Financial Statement Analysis

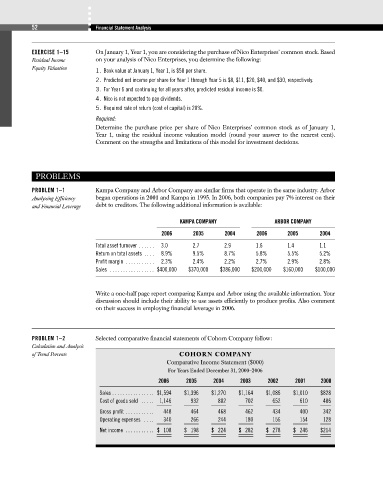

EXERCISE 1–15 On January 1, Year 1, you are considering the purchase of Nico Enterprises’ common stock. Based

Residual Income on your analysis of Nico Enterprises, you determine the following:

Equity Valuation

1. Book value at January 1, Year 1, is $50 per share.

2. Predicted net income per share for Year 1 through Year 5 is $8, $11, $20, $40, and $30, respectively.

3. For Year 6 and continuing for all years after, predicted residual income is $0.

4. Nico is not expected to pay dividends.

5. Required rate of return (cost of capital) is 20%.

Required:

Determine the purchase price per share of Nico Enterprises’ common stock as of January 1,

Year 1, using the residual income valuation model (round your answer to the nearest cent).

Comment on the strengths and limitations of this model for investment decisions.

PROBLEMS

PROBLEM 1–1 Kampa Company and Arbor Company are similar firms that operate in the same industry. Arbor

Analyzing Efficiency began operations in 2001 and Kampa in 1995. In 2006, both companies pay 7% interest on their

and Financial Leverage debt to creditors. The following additional information is available:

KAMPA COMPANY ARBOR COMPANY

2006 2005 2004 2006 2005 2004

Total asset turnover . . . . . . 3.0 2.7 2.9 1.6 1.4 1.1

Return on total assets . . . . 8.9% 9.5% 8.7% 5.8% 5.5% 5.2%

Profit margin . . . . . . . . . . . 2.3% 2.4% 2.2% 2.7% 2.9% 2.8%

Sales . . . . . . . . . . . . . . . . . $400,000 $370,000 $386,000 $200,000 $160,000 $100,000

Write a one-half page report comparing Kampa and Arbor using the available information. Your

discussion should include their ability to use assets efficiently to produce profits. Also comment

on their success in employing financial leverage in 2006.

PROBLEM 1–2 Selected comparative financial statements of Cohorn Company follow:

Calculation and Analysis

of Trend Percents COHORN COMPANY

Comparative Income Statement ($000)

For Years Ended December 31, 2000–2006

2006 2005 2004 2003 2002 2001 2000

Sales . . . . . . . . . . . . . . . . $1,594 $1,396 $1,270 $1,164 $1,086 $1,010 $828

Cost of goods sold . . . . . 1,146 932 802 702 652 610 486

Gross profit . . . . . . . . . . . 448 464 468 462 434 400 342

Operating expenses . . . . 340 266 244 180 156 154 128

Net income . . . . . . . . . . . $ 108 $ 198 $ 224 $ 282 $ 278 $ 246 $214