Page 80 - Financial Statement Analysis

P. 80

sub79433_ch01.qxd 4/7/08 11:21 AM Page 57

Chapter One | Overview of Financial Statement Analysis 57

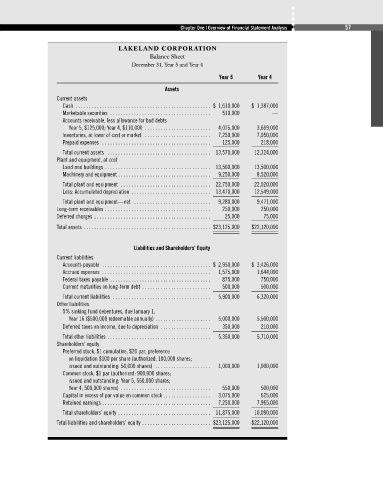

LAKELAND CORPORATION

Balance Sheet

December 31, Year 5 and Year 4

Year 5 Year 4

Assets

Current assets

Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,610,000 $ 1,387,000

Marketable securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 510,000 —

Accounts receivable, less allowance for bad debts

Year 5, $125,000; Year 4, $110,000 . . . . . . . . . . . . . . . . . . . . . . . . . 4,075,000 3,669,000

Inventories, at lower of cost or market . . . . . . . . . . . . . . . . . . . . . . . . . 7,250,000 7,050,000

Prepaid expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 125,000 218,000

Total current assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13,570,000 12,324,000

Plant and equipment, at cost

Land and buildings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13,500,000 13,500,000

Machinery and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,250,000 8,520,000

Total plant and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22,750,000 22,020,000

Less: Accumulated depreciation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13,470,000 12,549,000

Total plant and equipment—net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,280,000 9,471,000

Long-term receivables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 250,000 250,000

Deferred charges . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 25,000 75,000

Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $23,125,000 $22,120,000

Liabilities and Shareholders’ Equity

Current liabilities

Accounts payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,950,000 $ 3,426,000

Accrued expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,575,000 1,644,000

Federal taxes payable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 875,000 750,000

Current maturities on long-term debt . . . . . . . . . . . . . . . . . . . . . . . . . . 500,000 500,000

Total current liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,900,000 6,320,000

Other liabilities

5% sinking fund debentures, due January 1,

Year 16 ($500,000 redeemable annually) . . . . . . . . . . . . . . . . . . . . . 5,000,000 5,500,000

Deferred taxes on income, due to depreciation . . . . . . . . . . . . . . . . . . . 350,000 210,000

Total other liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,350,000 5,710,000

Shareholders’ equity

Preferred stock, $1 cumulative, $20 par, preference

on liquidation $100 per share (authorized: 100,000 shares;

issued and outstanding: 50,000 shares) . . . . . . . . . . . . . . . . . . . . . 1,000,000 1,000,000

Common stock, $1 par (authorized: 900,000 shares;

issued and outstanding: Year 5, 550,000 shares;

Year 4, 500,000 shares) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 550,000 500,000

Capital in excess of par value on common stock . . . . . . . . . . . . . . . . . . 3,075,000 625,000

Retained earnings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,250,000 7,965,000

Total shareholders’ equity . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11,875,000 10,090,000

Total liabilities and shareholders’ equity . . . . . . . . . . . . . . . . . . . . . . . . . . $23,125,000 $22,120,000