Page 85 - Financial Statement Analysis

P. 85

sub79433_ch01.qxd 4/7/08 11:21 AM Page 62

62 Financial Statement Analysis

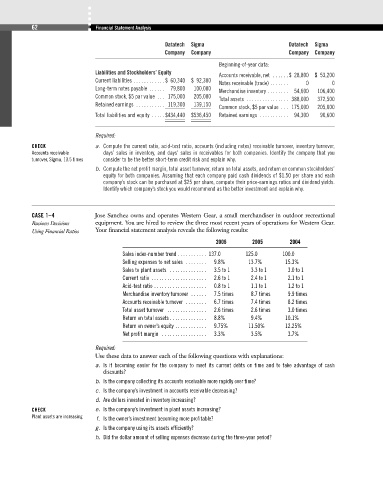

Datatech Sigma Datatech Sigma

Company Company Company Company

Beginning-of-year data:

Liabilities and Stockholders’ Equity

Accounts receivable, net . . . . . . $ 28,800 $ 53,200

Current liabilities . . . . . . . . . . . . $ 60,340 $ 92,300

Notes receivable (trade) . . . . . . . 0 0

Long-term notes payable . . . . . . 79,800 100,000

Merchandise inventory . . . . . . . . 54,600 106,400

Common stock, $5 par value . . . 175,000 205,000

Total assets . . . . . . . . . . . . . . . . 388,000 372,500

Retained earnings . . . . . . . . . . . 119,300 139,150

Common stock, $5 par value . . . 175,000 205,000

Total liabilities and equity . . . . . $434,440 $536,450 Retained earnings . . . . . . . . . . . 94,300 90,600

Required:

CHECK a. Compute the current ratio, acid-test ratio, accounts (including notes) receivable turnover, inventory turnover,

Accounts receivable days’ sales in inventory, and days’ sales in receivables for both companies. Identify the company that you

turnover, Sigma, 13.5 times consider to be the better short-term credit risk and explain why.

b. Compute the net profit margin, total asset turnover, return on total assets, and return on common stockholders’

equity for both companies. Assuming that each company paid cash dividends of $1.50 per share and each

company’s stock can be purchased at $25 per share, compute their price-earnings ratios and dividend yields.

Identify which company’s stock you would recommend as the better investment and explain why.

CASE 1–4 Jose Sanchez owns and operates Western Gear, a small merchandiser in outdoor recreational

Business Decisions equipment. You are hired to review the three most recent years of operations for Western Gear.

Using Financial Ratios Your financial statement analysis reveals the following results:

2006 2005 2004

Sales index-number trend . . . . . . . . . . . 137.0 125.0 100.0

Selling expenses to net sales . . . . . . . . 9.8% 13.7% 15.3%

Sales to plant assets . . . . . . . . . . . . . . 3.5 to 1 3.3 to 1 3.0 to 1

Current ratio . . . . . . . . . . . . . . . . . . . . . 2.6 to 1 2.4 to 1 2.1 to 1

Acid-test ratio . . . . . . . . . . . . . . . . . . . . 0.8 to 1 1.1 to 1 1.2 to 1

Merchandise inventory turnover . . . . . . 7.5 times 8.7 times 9.9 times

Accounts receivable turnover . . . . . . . . 6.7 times 7.4 times 8.2 times

Total asset turnover . . . . . . . . . . . . . . . 2.6 times 2.6 times 3.0 times

Return on total assets . . . . . . . . . . . . . . 8.8% 9.4% 10.1%

Return on owner’s equity . . . . . . . . . . . . 9.75% 11.50% 12.25%

Net profit margin . . . . . . . . . . . . . . . . . 3.3% 3.5% 3.7%

Required:

Use these data to answer each of the following questions with explanations:

a. Is it becoming easier for the company to meet its current debts on time and to take advantage of cash

discounts?

b. Is the company collecting its accounts receivable more rapidly over time?

c. Is the company’s investment in accounts receivable decreasing?

d. Are dollars invested in inventory increasing?

CHECK e. Is the company’s investment in plant assets increasing?

Plant assets are increasing

f. Is the owner’s investment becoming more profitable?

g. Is the company using its assets efficiently?

h. Did the dollar amount of selling expenses decrease during the three-year period?