Page 84 - Financial Statement Analysis

P. 84

sub79433_ch01.qxd 4/7/08 11:21 AM Page 61

Chapter One | Overview of Financial Statement Analysis 61

CASES

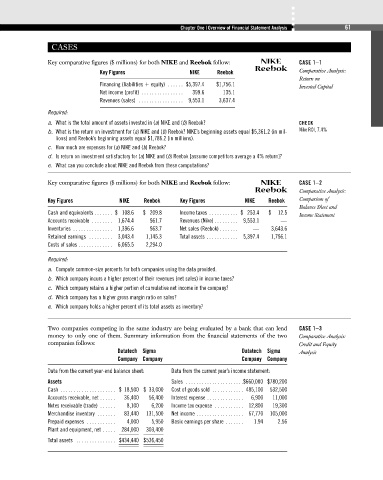

Key comparative figures ($ millions) for both NIKE and Reebok follow: NIKE CASE 1–1

Reebok

Key Figures NIKE Reebok Comparative Analysis:

Return on

Financing (liabilities equity) . . . . . . $5,397.4 $1,756.1 Invested Capital

Net income (profit) . . . . . . . . . . . . . . . . 399.6 135.1

Revenues (sales) . . . . . . . . . . . . . . . . . 9,553.1 3,637.4

Required:

a. What is the total amount of assets invested in (a) NIKE and (b) Reebok? CHECK

b. What is the return on investment for (a) NIKE and (b) Reebok? NIKE’s beginning assets equal $5,361.2 (in mil- Nike ROI, 7.4%

lions) and Reebok’s beginning assets equal $1,786.2 (in millions).

c. How much are expenses for (a) NIKE and (b) Reebok?

d. Is return on investment satisfactory for (a) NIKE and (b) Reebok [assume competitors average a 4% return]?

e. What can you conclude about NIKE and Reebok from these computations?

Key comparative figures ($ millions) for both NIKE and Reebok follow: NIKE CASE 1–2

Reebok Comparative Analysis:

Key Figures NIKE Reebok Key Figures NIKE Reebok Comparison of

Balance Sheet and

Cash and equivalents . . . . . . . $ 108.6 $ 209.8 Income taxes . . . . . . . . . . . $ 253.4 $ 12.5 Income Statement

Accounts receivable . . . . . . . . 1,674.4 561.7 Revenues (Nike) . . . . . . . . . 9,553.1 —

Inventories . . . . . . . . . . . . . . . 1,396.6 563.7 Net sales (Reebok) . . . . . . . — 3,643.6

Retained earnings . . . . . . . . . 3,043.4 1,145.3 Total assets . . . . . . . . . . . . 5,397.4 1,756.1

Costs of sales . . . . . . . . . . . . . 6,065.5 2,294.0

Required:

a. Compute common-size percents for both companies using the data provided.

b. Which company incurs a higher percent of their revenues (net sales) in income taxes?

c. Which company retains a higher portion of cumulative net income in the company?

d. Which company has a higher gross margin ratio on sales?

e. Which company holds a higher percent of its total assets as inventory?

Two companies competing in the same industry are being evaluated by a bank that can lend CASE 1–3

money to only one of them. Summary information from the financial statements of the two Comparative Analysis:

companies follows: Credit and Equity

Datatech Sigma Datatech Sigma Analysis

Company Company Company Company

Data from the current year-end balance sheet: Data from the current year’s income statement:

Assets Sales . . . . . . . . . . . . . . . . . . . . . .$660,000 $780,200

Cash . . . . . . . . . . . . . . . . . . . . . $ 18,500 $ 33,000 Cost of goods sold . . . . . . . . . . . . 485,100 532,500

Accounts receivable, net . . . . . . 36,400 56,400 Interest expense . . . . . . . . . . . . . . 6,900 11,000

Notes receivable (trade) . . . . . . 8,100 6,200 Income tax expense . . . . . . . . . . . 12,800 19,300

Merchandise inventory . . . . . . . 83,440 131,500 Net income . . . . . . . . . . . . . . . . . . 67,770 105,000

Prepaid expenses . . . . . . . . . . . 4,000 5,950 Basic earnings per share . . . . . . . 1.94 2.56

Plant and equipment, net . . . . . 284,000 303,400

Total assets . . . . . . . . . . . . . . . $434,440 $536,450