Page 69 - Microsoft Word - CAFR Title Page

P. 69

HUDSON CITY SCHOOL DISTRICT

SUMMIT COUNTY, OHIO

NOTES TO THE BASIC FINANCIAL STATEMENTS

FOR THE FISCAL YEAR ENDED JUNE 30, 2016

NOTE 3 - DEPOSITS AND INVESTMENTS - (Continued)

Custodial Credit Risk: For an investment, custodial credit risk is the risk that, in the event of the

failure of the counterparty, the District will not be able to recover the value of its investments or

collateral securities that are in the possession of an outside party. Of the District’s investment in

repurchase agreements, the entire balance is collateralized by underlying securities that are held by the

investment’s counterparty, not in the name of the District. Ohio law requires the market value of the

securities subject to repurchase agreements must exceed the principal value of securities subject to a

repurchase agreement by 2%. The District has no investment policy dealing with investment custodial

risk beyond the requirement in State statute that prohibits payment for investments prior to the delivery

of the securities representing such investments to the treasurer or qualified trustee.

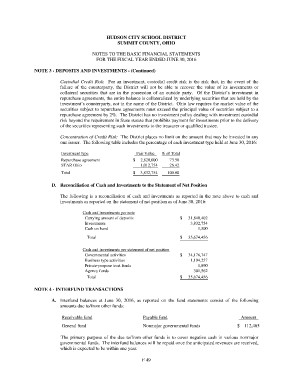

Concentration of Credit Risk: The District places no limit on the amount that may be invested in any

one issuer. The following table includes the percentage of each investment type held at June 30, 2016:

Investment type Fair Value % of Total

Repurchase agreement

STAR Ohio $ 2,820,000 73.58

1,012,754 26.42

Total

$ 3,832,754 100.00

D. Reconciliation of Cash and Investments to the Statement of Net Position

The following is a reconciliation of cash and investments as reported in the note above to cash and

investments as reported on the statement of net position as of June 30, 2016:

Cash and investments per note $ 31,840,402

Carrying amount of deposits 3,832,754

Investments 1,300

Cash on hand

$ 35,674,456

Total

Cash and investments per statement of net position $ 34,176,747

Governmental activities 1,194,257

Business type activities 1,890

Private-purpose trust funds 301,562

Agency funds

$ 35,674,456

Total

NOTE 4 - INTERFUND TRANSACTIONS

A. Interfund balances at June 30, 2016, as reported on the fund statements consist of the following

amounts due to/from other funds:

Receivable fund Payable fund Amount

General fund Nonmajor governmental funds $ 112,465

The primary purpose of the due to/from other funds is to cover negative cash in various nonmajor

governmental funds. The interfund balances will be repaid once the anticipated revenues are received,

which is expected to be within one year.

F 49