Page 73 - Microsoft Word - CAFR Title Page

P. 73

HUDSON CITY SCHOOL DISTRICT

SUMMIT COUNTY, OHIO

NOTES TO THE BASIC FINANCIAL STATEMENTS

FOR THE FISCAL YEAR ENDED JUNE 30, 2016

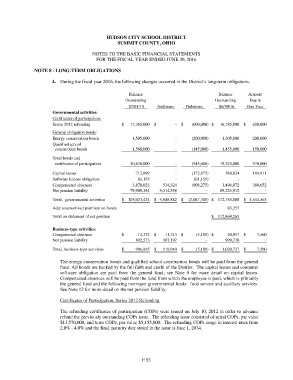

NOTE 8 - LONG-TERM OBLIGATIONS

A. During the fiscal year 2016, the following changes occurred in the District’s long-term obligations.

Balance Additions Deletions Balance Amount

Outstanding Outstanding Due in

One Year

07/01/15 06/30/16

Governmental activities: $ 17,385,000 $ - $ (600,000) $ 16,785,000 $ 620,000

Certificates of participation: 1,505,000

Series 2012 refunding 1,580,000 - (200,000) 1,305,000 200,000

General obligation bonds: - (145,000) 1,435,000 150,000

Energy conservation bonds

Qualified school

construction bonds

Total bonds and 20,470,000 - (945,000) 19,525,000 970,000

certificates of participation

Capital leases 712,899 - (172,875) 540,024 184,911

Software license obligation 61,158 - (61,158) - -

Compensated absences 534,324 (908,275)

Net pension liability 3,870,023 9,314,558 3,496,072 389,652

79,909,354 - 89,223,912 -

Total, governmental activities $ 105,023,434 $ 9,848,882 $ (2,087,308) $ 112,785,008 $ 1,544,563

Add: unamortized premium on bonds 83,257

Total on statement of net position $ 112,868,265

Business-type activities: $ 14,322 $ 11,743 $ (5,108) $ 20,957 $ 7,560

Compensated absences - 999,770 -

Net pension liability 892,573 107,197

(5,108) $ 1,020,727 $ 7,560

Total, business-type activities $ 906,895 $ 118,940 $

The energy conservation bonds and qualified school construction bonds will be paid from the general

fund. All bonds are backed by the full faith and credit of the District. The capital leases and computer

software obligation are paid from the general fund; see Note 9 for more detail on capital leases.

Compensated absences will be paid from the fund from which the employee is paid, which is primarily

the general fund and the following nonmajor governmental funds: food service and auxiliary services.

See Note 12 for more detail on the net pension liability.

Certificates of Participation, Series 2012 Refunding

The refunding certificates of participation (COPs) were issued on July 10, 2012 in order to advance

refund the previously outstanding COPs issue. The refunding issue consisted of serial COPs, par value

$13,570,000, and term COPs, par value $5,155,000. The refunding COPs range in interest rates from

2.0% - 4.0% and the final maturity date stated in the issue is June 1, 2034.

F 53