Page 71 - Microsoft Word - CAFR Title Page

P. 71

HUDSON CITY SCHOOL DISTRICT

SUMMIT COUNTY, OHIO

NOTES TO THE BASIC FINANCIAL STATEMENTS

FOR THE FISCAL YEAR ENDED JUNE 30, 2016

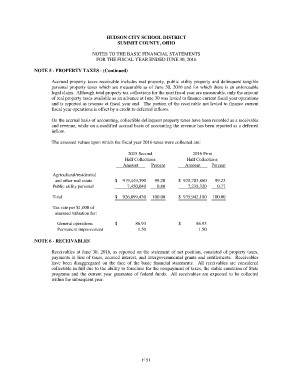

NOTE 5 - PROPERTY TAXES - (Continued)

Accrued property taxes receivable includes real property, public utility property and delinquent tangible

personal property taxes which are measurable as of June 30, 2016 and for which there is an enforceable

legal claim. Although total property tax collections for the next fiscal year are measurable, only the amount

of real property taxes available as an advance at June 30 was levied to finance current fiscal year operations

and is reported as revenue at fiscal year end. The portion of the receivable not levied to finance current

fiscal year operations is offset by a credit to deferred inflows.

On the accrual basis of accounting, collectible delinquent property taxes have been recorded as a receivable

and revenue, while on a modified accrual basis of accounting the revenue has been reported as a deferred

inflow.

The assessed values upon which the fiscal year 2016 taxes were collected are:

2015 Second 2016 First

Half Collections

Half Collections Amount Percent

Amount Percent $ 928,703,860 99.23

7,238,320 0.77

Agricultural/residential $ 919,449,390 99.20

and other real estate 7,450,040 0.80 $ 935,942,180 100.00

Public utility personal $ 926,899,430 100.00

Total

Tax rate per $1,000 of $ 86.93 $ 86.93

assessed valuation for: 1.50 1.50

General operations

Permanent improvement

NOTE 6 - RECEIVABLES

Receivables at June 30, 2016, as reported on the statement of net position, consisted of property taxes,

payments in lieu of taxes, accrued interest, and intergovernmental grants and entitlements. Receivables

have been disaggregated on the face of the basic financial statements. All receivables are considered

collectible in full due to the ability to foreclose for the nonpayment of taxes, the stable condition of State

programs and the current year guarantee of federal funds. All receivables are expected to be collected

within the subsequent year.

F 51