Page 72 - Microsoft Word - CAFR Title Page

P. 72

HUDSON CITY SCHOOL DISTRICT

SUMMIT COUNTY, OHIO

NOTES TO THE BASIC FINANCIAL STATEMENTS

FOR THE FISCAL YEAR ENDED JUNE 30, 2016

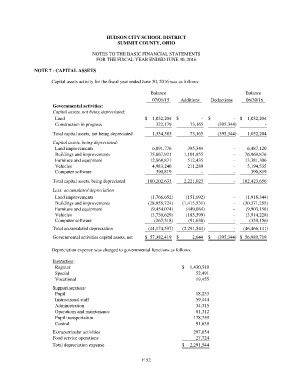

NOTE 7 - CAPITAL ASSETS

Capital assets activity for the fiscal year ended June 30, 2016 was as follows:

Balance Additions Deductions Balance

07/01/15 06/30/16

Governmental activities: $ 1,032,204 $ -$ - $ 1,032,204

Capital assets, not being depreciated: 322,179 73,165

(395,344) -

Land 1,354,383 73,165

Construction in progress (395,344) 1,032,204

Total capital assets, not being depreciated 6,091,776 395,344 - 6,487,120

75,867,921 1,101,955 - 76,969,876

Capital assets, being depreciated: 12,868,871 - 13,381,306

Land improvements 512,435 - 5,194,535

Buildings and improvements 4,983,246 211,289 - 390,819

Furniture and equipment 390,819

Vehicles - - 102,423,656

Computer software 100,202,633

2,221,023

Total capital assets, being depreciated

(1,766,652) (151,692) - (1,918,344)

Less: accumulated depreciation (28,955,724) (1,415,531) - (30,371,255)

Land improvements - (9,903,158)

Buildings and improvements (9,454,074) (449,084) - (3,914,228)

Furniture and equipment (3,730,629) (183,599) - (359,156)

Vehicles

Computer software (267,518) (91,638) 0

Total accumulated depreciation (44,174,597) (2,291,544) - (46,466,141)

Governmental activities capital assets, net $ 57,382,419 $ 2,644 $ (395,344) $ 56,989,719

Depreciation expense was charged to governmental functions as follows:

Instruction: $ 1,430,519

Regular 52,491

Special 19,455

Vocational

18,233

Support services: 59,444

Pupil 34,315

Instructional staff 81,312

Administration 178,759

Operations and maintenance 91,638

Pupil transportation

Central 297,654

27,724

Extracurricular activities $ 2,291,544

Food service operations

Total depreciation expense

F 52