Page 75 - Microsoft Word - CAFR Title Page

P. 75

HUDSON CITY SCHOOL DISTRICT

SUMMIT COUNTY, OHIO

NOTES TO THE BASIC FINANCIAL STATEMENTS

FOR THE FISCAL YEAR ENDED JUNE 30, 2016

NOTE 8 - LONG-TERM OBLIGATIONS - (Continued)

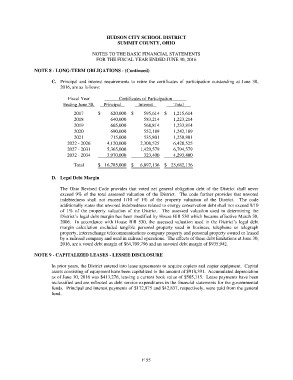

C. Principal and interest requirements to retire the certificates of participation outstanding at June 30,

2016, are as follows:

Fiscal Year Certificates of Participation

Ending June 30, Principal Interest Total

2017 $ 620,000 $ 595,614 $ 1,215,614

2018

2019 640,000 583,214 1,223,214

2020

2021 665,000 568,814 1,233,814

2022 - 2026

2027 - 2031 690,000 552,189 1,242,189

2032 - 2034

715,000 535,801 1,250,801

4,120,000 2,308,525 6,428,525

5,365,000 1,429,579 6,794,579

3,970,000 323,400 4,293,400

Total $ 16,785,000 $ 6,897,136 $ 23,682,136

D. Legal Debt Margin

The Ohio Revised Code provides that voted net general obligation debt of the District shall never

exceed 9% of the total assessed valuation of the District. The code further provides that unvoted

indebtedness shall not exceed 1/10 of 1% of the property valuation of the District. The code

additionally states that unvoted indebtedness related to energy conservation debt shall not exceed 9/10

of 1% of the property valuation of the District. The assessed valuation used in determining the

District’s legal debt margin has been modified by House Bill 530 which became effective March 30,

2006. In accordance with House Bill 530, the assessed valuation used in the District’s legal debt

margin calculation excluded tangible personal property used in business, telephone or telegraph

property, interexchange telecommunications company property and personal property owned or leased

by a railroad company and used in railroad operations. The effects of these debt limitations at June 30,

2016, are a voted debt margin of $64,709,796 and an unvoted debt margin of $935,942.

NOTE 9 - CAPITALIZED LEASES - LESSEE DISCLOSURE

In prior years, the District entered into lease agreements to acquire copiers and copier equipment. Capital

assets consisting of equipment have been capitalized in the amount of $918,391. Accumulated depreciation

as of June 30, 2016 was $413,276, leaving a current book value of $505,115. Lease payments have been

reclassified and are reflected as debt service expenditures in the financial statements for the governmental

funds. Principal and interest payments of $172,875 and $42,837, respectively, were paid from the general

fund.

F 55