Page 10 - The Panozzo Team - VA Home Loan Guide

P. 10

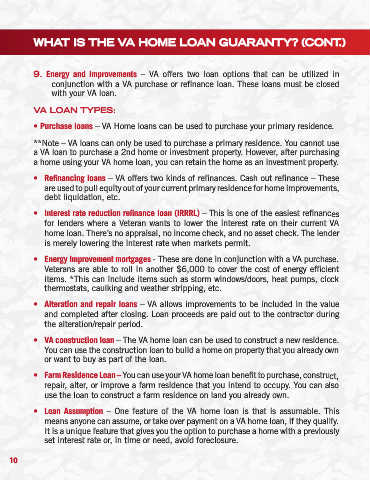

WHAT IS THE VA HOME LOAN GUARANTY? (CONT.)

9. Energy and Improvements – VA offers two loan options that can be utilized in

conjunction with a VA purchase or refinance loan. These loans must be closed

with your VA loan.

VA LOAN TYPES:

• Purchase loans – VA Home loans can be used to purchase your primary residence.

**Note – VA loans can only be used to purchase a primary residence. You cannot use

a VA loan to purchase a 2nd home or investment property. However, after purchasing

a home using your VA home loan, you can retain the home as an investment property.

• Refinancing loans – VA offers two kinds of refinances. Cash out refinance – These

are used to pull equity out of your current primary residence for home improvements,

debt liquidation, etc.

• Interest rate reduction refinance loan (IRRRL) – This is one of the easiest refinances

for lenders where a Veteran wants to lower the interest rate on their current VA

home loan. There’s no appraisal, no income check, and no asset check. The lender

is merely lowering the interest rate when markets permit.

• Energy Improvement mortgages - These are done in conjunction with a VA purchase.

Veterans are able to roll in another $6,000 to cover the cost of energy efficient

items. *This can include items such as storm windows/doors, heat pumps, clock

thermostats, caulking and weather stripping, etc.

• Alteration and repair loans – VA allows improvements to be included in the value

and completed after closing. Loan proceeds are paid out to the contractor during

the alteration/repair period.

• VA construction loan – The VA home loan can be used to construct a new residence.

You can use the construction loan to build a home on property that you already own

or want to buy as part of the loan.

• Farm Residence Loan – You can use your VA home loan benefit to purchase, construct,

repair, alter, or improve a farm residence that you intend to occupy. You can also

use the loan to construct a farm residence on land you already own.

• Loan Assumption – One feature of the VA home loan is that is assumable. This

means anyone can assume, or take over payment on a VA home loan, if they qualify.

It is a unique feature that gives you the option to purchase a home with a previously

set interest rate or, in time or need, avoid foreclosure.

10

10