Page 11 - The Panozzo Team - VA Home Loan Guide

P. 11

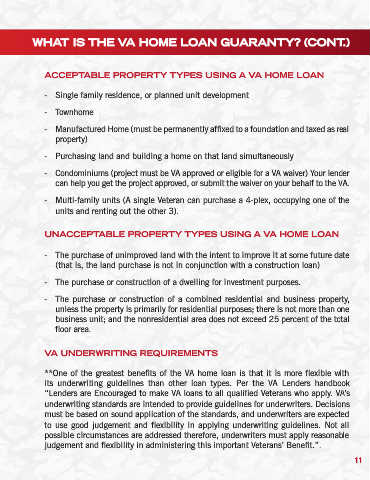

WHAT IS THE VA HOME LOAN GUARANTY? (CONT.)

ACCEPTABLE PROPERTY TYPES USING A VA HOME LOAN

- Single family residence, or planned unit development

- Townhome

- Manufactured Home (must be permanently affixed to a foundation and taxed as real

property)

- Purchasing land and building a home on that land simultaneously

- Condominiums (project must be VA approved or eligible for a VA waiver) Your lender

can help you get the project approved, or submit the waiver on your behalf to the VA.

- Multi-family units (A single Veteran can purchase a 4-plex, occupying one of the

units and renting out the other 3).

UNACCEPTABLE PROPERTY TYPES USING A VA HOME LOAN

- The purchase of unimproved land with the intent to improve it at some future date

(that is, the land purchase is not in conjunction with a construction loan)

- The purchase or construction of a dwelling for investment purposes.

- The purchase or construction of a combined residential and business property,

unless the property is primarily for residential purposes; there is not more than one

business unit; and the nonresidential area does not exceed 25 percent of the total

floor area.

VA UNDERWRITING REQUIREMENTS

**One of the greatest benefits of the VA home loan is that it is more flexible with

its underwriting guidelines than other loan types. Per the VA Lenders handbook

“Lenders are Encouraged to make VA loans to all qualified Veterans who apply. VA’s

underwriting standards are intended to provide guidelines for underwriters. Decisions

must be based on sound application of the standards, and underwriters are expected

to use good judgement and flexibility in applying underwriting guidelines. Not all

possible circumstances are addressed therefore, underwriters must apply reasonable

judgement and flexibility in administering this important Veterans’ Benefit.”.

11

11