Page 15 - The Panozzo Team - VA Home Loan Guide

P. 15

WHAT IS THE VA HOME LOAN GUARANTY? (CONT.)

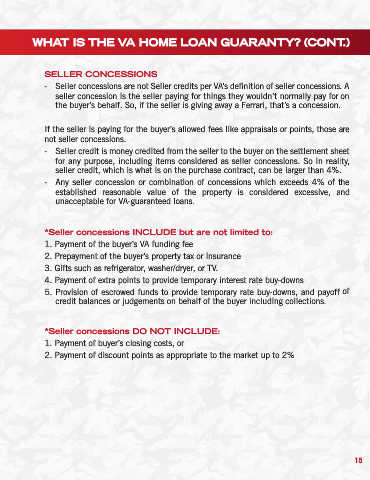

SELLER CONCESSIONS

- Seller concessions are not Seller credits per VA’s definition of seller concessions. A

seller concession is the seller paying for things they wouldn’t normally pay for on

the buyer’s behalf. So, if the seller is giving away a Ferrari, that’s a concession.

If the seller is paying for the buyer’s allowed fees like appraisals or points, those are

not seller concessions.

- Seller credit is money credited from the seller to the buyer on the settlement sheet

for any purpose, including items considered as seller concessions. So in reality,

seller credit, which is what is on the purchase contract, can be larger than 4%.

- Any seller concession or combination of concessions which exceeds 4% of the

established reasonable value of the property is considered excessive, and

unacceptable for VA-guaranteed loans.

*Seller concessions INCLUDE but are not limited to:

1. Payment of the buyer’s VA funding fee

2. Prepayment of the buyer’s property tax or insurance

3. Gifts such as refrigerator, washer/dryer, or TV.

4. Payment of extra points to provide temporary interest rate buy-downs

5. Provision of escrowed funds to provide temporary rate buy-downs, and payoff of

credit balances or judgements on behalf of the buyer including collections.

*Seller concessions DO NOT INCLUDE:

1. Payment of buyer’s closing costs, or

2. Payment of discount points as appropriate to the market up to 2%

15