Page 13 - The Panozzo Team - VA Home Loan Guide

P. 13

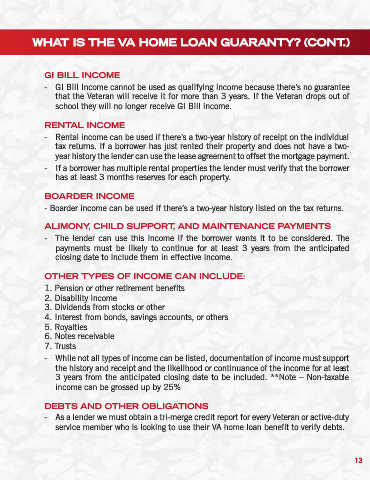

WHAT IS THE VA HOME LOAN GUARANTY? (CONT.)

GI BILL INCOME

- GI Bill Income cannot be used as qualifying income because there’s no guarantee

that the Veteran will receive it for more than 3 years. If the Veteran drops out of

school they will no longer receive GI Bill income.

RENTAL INCOME

- Rental income can be used if there’s a two-year history of receipt on the individual

tax returns. If a borrower has just rented their property and does not have a two-

year history the lender can use the lease agreement to offset the mortgage payment.

- If a borrower has multiple rental properties the lender must verify that the borrower

has at least 3 months reserves for each property.

BOARDER INCOME

- Boarder income can be used If there’s a two-year history listed on the tax returns.

ALIMONY, CHILD SUPPORT, AND MAINTENANCE PAYMENTS

- The lender can use this income if the borrower wants it to be considered. The

payments must be likely to continue for at least 3 years from the anticipated

closing date to include them in effective income.

OTHER TYPES OF INCOME CAN INCLUDE:

1. Pension or other retirement benefits

2. Disability income

3. Dividends from stocks or other

4. Interest from bonds, savings accounts, or others

5. Royalties

6. Notes receivable

7. Trusts

- While not all types of income can be listed, documentation of income must support

the history and receipt and the likelihood or continuance of the income for at least

3 years from the anticipated closing date to be included. **Note – Non-taxable

income can be grossed up by 25%

DEBTS AND OTHER OBLIGATIONS

- As a lender we must obtain a tri-merge credit report for every Veteran or active-duty

service member who is looking to use their VA home loan benefit to verify debts.

13