Page 30 - Insurance Times September 2020

P. 30

GROWTH' up to the year 2019 but COVID-19 Recession will A New World Economic Order seems to be in making and

impact 'Stagflations' till 2021. Thus World Insurance and we live in 'Transition Periods' up to 2021.

Reinsurance will witness unprecedented 'Halting' of all

economic activities resulting from Lockdown for long term Global Reinsurance Premiums for the year 2019 are

and Isolation / Distancing of People everywhere in the selectively listed for the First 15 major economics of 2019

world, paralyzing Global Contacts by transportation through which cover almost 83% of Total Insurance Premium of Life

Rails, Roads, Aircrafts and Cyber Links. and Nonlife business.

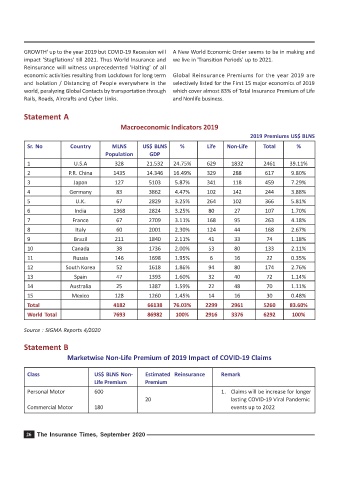

Statement A

Macroeconomic Indicators 2019

2019 Premiums US$ BLNS

Sr. No Country MLNS US$ BLNS % Life Non-Life Total %

Population GDP

1 U.S.A 328 21.532 24.75% 629 1832 2461 39.11%

2 P.R. China 1435 14.346 16.49% 329 288 617 9.80%

3 Japan 127 5103 5.87% 341 118 459 7.29%

4 Germany 83 3862 4.47% 102 142 244 3.88%

5 U.K. 67 2829 3.25% 264 102 366 5.81%

6 India 1368 2824 3.25% 80 27 107 1.70%

7 France 67 2709 3.11% 168 95 263 4.18%

8 Italy 60 2001 2.30% 124 44 168 2.67%

9 Brazil 211 1840 2.11% 41 33 74 1.18%

10 Canada 38 1736 2.00% 53 80 133 2.11%

11 Russia 146 1698 1.95% 6 16 22 0.35%

12 South Korea 52 1618 1.86% 94 80 174 2.76%

13 Spain 47 1393 1.60% 32 40 72 1.14%

14 Australia 25 1387 1.59% 22 48 70 1.11%

15 Mexico 128 1260 1.45% 14 16 30 0.48%

Total 4182 66138 76.03% 2299 2961 5260 83.60%

World Total 7693 86982 100% 2916 3376 6292 100%

Source : SIGMA Reports 4/2020

Statement B

Marketwise Non-Life Premium of 2019 Impact of COVID-19 Claims

Class US$ BLNS Non- Estimated Reinsurance Remark

Life Premium Premium

Personal Motor 600 1. Claims will be increase for longer

20 lasting COVID-19 Viral Pandemic

Commercial Motor 180 events up to 2022

26 The Insurance Times, September 2020