Page 31 - Insurance Times September 2020

P. 31

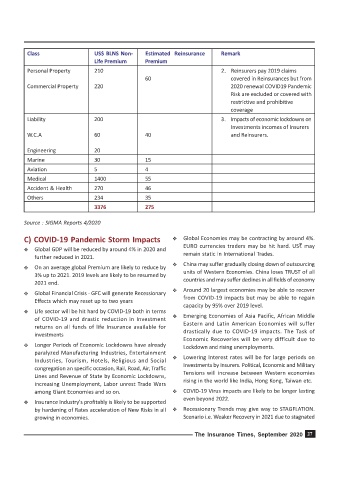

Class US$ BLNS Non- Estimated Reinsurance Remark

Life Premium Premium

Personal Property 210 2. Reinsurers pay 2019 claims

60 covered in Reinsurances but from

Commercial Property 220 2020 renewal COVID19 Pandemic

Risk are excluded or covered with

restrictive and prohibitive

coverage

Liability 200 3. Impacts of economic lockdowns on

Investments incomes of Insurers

W.C.A 60 40 and Reinsurers.

Engineering 20

Marine 30 15

Aviation 5 4

Medical 1400 55

Accident & Health 270 46

Others 234 35

3376 275

Source : SIGMA Reports 4/2020

C) COVID-19 Pandemic Storm Impacts Y Global Economies may be contracting by around 4%.

EURO currencies traders may be hit hard. US$ may

Y Global GDP will be reduced by around 4% in 2020 and

remain static in International Trades.

further reduced in 2021.

Y China may suffer gradually closing down of outsourcing

Y On an average global Premium are likely to reduce by

units of Western Economies. China loses TRUST of all

3% up to 2021. 2019 levels are likely to be resumed by

countries and may suffer declines in all fields of economy

2021 end.

Y Around 20 largest economies may be able to recover

Y Global Financial Crisis - GFC will generate Recessionary

Effects which may reset up to two years from COVID-19 impacts but may be able to regain

capacity by 95% over 2019 level.

Y Life sector will be hit hard by COVID-19 both in terms

Y Emerging Economies of Asia Pacific, African Middle

of COVID-19 and drastic reduction in Investment

Eastern and Latin American Economies will suffer

returns on all funds of life Insurance available for

investments drastically due to COVID-19 impacts. The Task of

Economic Recoveries will be very difficult due to

Y Longer Periods of Economic Lockdowns have already Lockdown and rising unemployments.

paralyzed Manufacturing Industries, Entertainment

Y Lowering Interest rates will be for large periods on

Industries, Tourism, Hotels, Religious and Social

congregation an specific occasion, Rail, Road, Air, Traffic Investments by Insurers. Political, Economic and Military

Tensions will increase between Western economies

Lines and Revenue of State by Economic Lockdowns,

rising in the world like India, Hong Kong, Taiwan etc.

increasing Unemployment, Labor unrest Trade Wars

among Giant Economies and so on. Y COVID-19 Virus impacts are likely to be longer lasting

even beyond 2022.

Y Insurance Industry's profitably is likely to be supported

by hardening of Rates acceleration of New Risks in all Y Recessionary Trends may give way to STAGFLATION.

growing in economies. Scenario i.e. Weaker Recovery in 2021 due to stagnated

The Insurance Times, September 2020 27