Page 32 - Insurance Times September 2020

P. 32

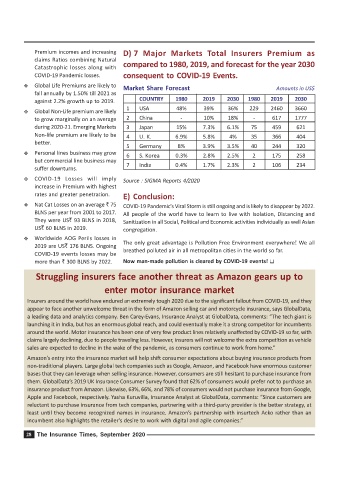

Premium incomes and increasing D) 7 Major Markets Total Insurers Premium as

claims Ratios combining Natural

Catastrophic losses along with compared to 1980, 2019, and forecast for the year 2030

COVID-19 Pandemic losses. consequent to COVID-19 Events.

Y Global Life Premiums are likely to

Market Share Forecast Amounts in US$

fall annually by 1.50% till 2021 as

against 2.2% growth up to 2019. COUNTRY 1980 2019 2030 1980 2019 2030

1 USA 48% 39% 36% 229 2460 3660

Y Global Non-Life premium are likely

to grow marginally on an average 2 China - 10% 18% - 617 1777

during 2020-21. Emerging Markets 3 Japan 15% 7.3% 6.1% 75 459 621

Non-life premium are likely to be 4 U. K. 6.9% 5.8% 4% 35 366 404

better.

5 Germany 8% 3.9% 3.5% 40 244 320

Y Personal lines business may grow

6 S. Korea 0.3% 2.8% 2.5% 2 175 258

but commercial line business may

7 India 0.4% 1.7% 2.3% 2 106 234

suffer downturns.

Y COVID-19 Losses will imply Source : SIGMA Reports 4/2020

increase in Premium with highest

rates and greater penetration. E) Conclusion:

Y Nat Cat Losses on an average $ 75 COVID-19 Pandemic's Viral Storm is still ongoing and is likely to disappear by 2022.

BLNS per year from 2001 to 2017. All people of the world have to learn to live with Isolation, Distancing and

They were US$ 93 BLNS in 2018, Sanitization in all Social, Political and Economic activities individually as well Asian

US$ 60 BLNS in 2019. congregation.

Y Worldwide AOG Perils losses in

The only great advantage is Pollution Free Environment everywhere! We all

2019 are US$ 176 BLNS. Ongoing

breathed polluted air in all metropolitan cities in the world so far.

COVID-19 events losses may be

more than $ 300 BLNS by 2022. Now man-made pollution is cleared by COVID-19 events! T

Struggling insurers face another threat as Amazon gears up to

enter motor insurance market

Insurers around the world have endured an extremely tough 2020 due to the significant fallout from COVID-19, and they

appear to face another unwelcome threat in the form of Amazon selling car and motorcycle insurance, says GlobalData,

a leading data and analytics company. Ben Carey-Evans, Insurance Analyst at GlobalData, comments: “The tech giant is

launching it in India, but has an enormous global reach, and could eventually make it a strong competitor for incumbents

around the world. Motor insurance has been one of very few product lines relatively unaffected by COVID-19 so far, with

claims largely declining, due to people traveling less. However, insurers will not welcome the extra competition as vehicle

sales are expected to decline in the wake of the pandemic, as consumers continue to work from home.”

Amazon’s entry into the insurance market will help shift consumer expectations about buying insurance products from

non-traditional players. Large global tech companies such as Google, Amazon, and Facebook have enormous customer

bases that they can leverage when selling insurance. However, consumers are still hesitant to purchase insurance from

them. GlobalData’s 2019 UK Insurance Consumer Survey found that 62% of consumers would prefer not to purchase an

insurance product from Amazon. Likewise, 63%, 66%, and 78% of consumers would not purchase insurance from Google,

Apple and Facebook, respectively. Yasha Kuruvilla, Insurance Analyst at GlobalData, comments: “Since customers are

reluctant to purchase insurance from tech companies, partnering with a third-party provider is the better strategy, at

least until they become recognized names in insurance. Amazon’s partnership with insurtech Acko rather than an

incumbent also highlights the retailer’s desire to work with digital and agile companies.”

28 The Insurance Times, September 2020