Page 37 - The Insurance Times May 2021

P. 37

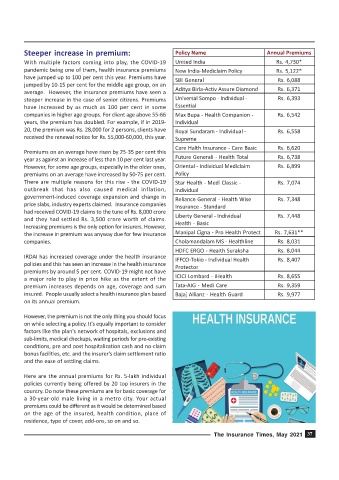

Steeper increase in premium: Policy Name Annual Premiums

With multiple factors coming into play, the COVID-19 United India Rs. 4,730*

pandemic being one of them, health insurance premiums New India-Mediclaim Policy Rs. 5,122*

have jumped up to 100 per cent this year. Premiums have SBI General Rs. 6,088

jumped by 10-15 per cent for the middle age group, on an

average. However, the insurance premiums have seen a Aditya Birla-Activ Assure Diamond Rs. 6,371

steeper increase in the case of senior citizens. Premiums Universal Sompo - Individual - Rs. 6,393

have increased by as much as 100 per cent in some Essential

companies in higher age groups. For client age above 55-66 Max Bupa - Health Companion - Rs. 6,542

years, the premium has doubled. For example, if in 2019- Individual

20, the premium was Rs. 28,000 for 2 persons, clients have Royal Sundaram - Individual - Rs. 6,558

received the renewal notice for Rs. 55,000-60,000, this year. Supreme

Care Halth Insurance - Care Basic Rs. 6,620

Premiums on an average have risen by 25-35 per cent this

year as against an increase of less than 10 per cent last year. Future Generali - Health Total Rs. 6,738

However, for some age groups, especially in the older ones, Oriental - Individual Mediclaim Rs. 6,899

premiums on an average have increased by 50-75 per cent. Policy

There are multiple reasons for this rise - the COVID-19 Star Health - Medi Classic - Rs. 7,074

outbreak that has also caused medical inflation, Individual

government-induced coverage expansion and change in

Reliance General - Health Wise Rs. 7,348

price slabs, industry experts claimed. Insurance companies Insurance - Standard

had received COVID-19 claims to the tune of Rs. 8,000 crore

and they had settled Rs. 3,500 crore worth of claims. Liberty General - Individual Rs. 7,448

Increasing premiums is the only option for insurers. However, Health - Basic

the increase in premium was anyway due for few insurance Manipal Cigna - Pro Health Protect Rs. 7,631**

companies. Cholamandalam MS - Healthline Rs. 8,031

HDFC ERGO - Health Suraksha Rs. 8,044

IRDAI has increased coverage under the health insurance IFFCO-Tokio - Individual Health Rs. 8,407

policies and this has seen an increase in the health insurance

Protector

premiums by around 5 per cent. COVID-19 might not have

ICICI Lombard - iHealth Rs. 8,655

a major role to play in price hike as the extent of the

premium increases depends on age, coverage and sum Tata-AIG - Medi Care Rs. 9,359

insured. People usually select a health insurance plan based Bajaj Allianz - Health Guard Rs. 9,977

on its annual premium.

However, the premium is not the only thing you should focus

on while selecting a policy. It's equally important to consider

factors like the plan's network of hospitals, exclusions and

sub-limits, medical checkups, waiting periods for pre-existing

conditions, pre and post hospitalization cash and no-claim

bonus facilities, etc. and the insurer's claim settlement ratio

and the ease of settling claims.

Here are the annual premiums for Rs. 5-lakh individual

policies currently being offered by 20 top insurers in the

country. Do note these premiums are for basic coverage for

a 30-year-old male living in a metro city. Your actual

premiums could be different as it would be determined based

on the age of the insured, health condition, place of

residence, type of cover, add-ons, so on and so.

The Insurance Times, May 2021 37