Page 45 - Insurance Times March 2017 Sample

P. 45

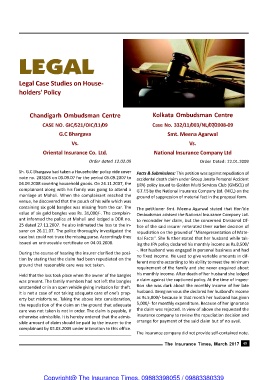

LEGAL

Legal Case Studies on House-

holders' Policy

Chandigarh Ombudsman Centre Kolkata Ombudsman Centre

CASE NO. GIC/521/OIC/11/09 Case No. 332/11/003/NL/07/2008-09

G.C Bhargava Smt. Meena Agarwal

Vs. Vs.

Oriental Insurance Co. Ltd. National Insurance Company Ltd

Order dated 12.02.09 Order Dated: 22.01.2009

Sh. G.C Bhargava had taken a Householder policy vide cover Facts & Submissions: This petition was against repudiation of

note no. 283105 on 03.09.07 for the period 05.09.2007 to accidental death claim under Group Janata Personal Accident

04.09.2008 covering household goods. On 24.11.2007, the (JPA) policy issued to Golden Multi Services Club (GMSCL) of

complainant along with his family was going to attend a G.T.F.S by the National Insurance Company Ltd. (NICL) on the

marriage at Mohali. When the complainant reached the ground of suppression of material fact in the proposal form.

venue, he discovered that the pouch of his wife which was

containing six gold bangles was missing from the car. The The petitioner Smt. Meena Agarwal stated that Hon'ble

value of six gold bangles was Rs. 31,000/-. The complain- Ombudsman advised the National Insurance Company Ltd.

ant informed the police at Mohali and lodged a DDR no. to reconsider her claim, but the concerned Divisional Of-

25 dated 27.11.2007. He also intimated the loss to the in- fice of the said insurer reiterated their earlier decision of

surer on 26.11.07. The police thoroughly investigated the repudiation on the ground of "Misrepresentation of Mate-

case but could not trace the missing purse. Accordingly they rial Facts". She further stated that her husband while tak-

issued an untraceable certificate on 04.03.2008. ing the JPA policy declared his monthly income as Rs.8,500/

-. Her husband was engaged in personal business and had

During the course of hearing the insurer clarified the posi-

no fixed income. He used to give variable amounts in dif-

tion by stating that the claim had been repudiated on the

ground that reasonable care was not taken. ferent months according to his ability to meet the minimum

requirement of the family and she never enquired about

Held that the loss took place when the owner of the bangles his monthly income. After death of her husband she lodged

was present. The family members had not left the bangles a claim against the captioned policy. At the time of inspec-

unattended or in an open vehicle giving invitation for theft. tion she was dark about the monthly income of her late

It is not a case of not taking adequate care of one's prop- husband. Being nervous she declared her husband's income

erty but misfortune. Taking the above into consideration, as Rs.5,000/- because in that month her husband has given

the repudiation of the claim on the ground that adequate 5,000/- for monthly expenditure. Because of her ignorance

care was not taken is not in order. The claim is payable, if the claim was rejected. In view of above she requested the

otherwise admissible. It is hereby ordered that the admis- insurance company to review the repudiation decision and

sible amount of claim should be paid by the insurer to the arrange for payment of the said claim but of no avail.

complainant by 05.03.2009 under intimation to this office.

The insurance company did not provide self-contained note.

The Insurance Times, March 2017 45

Copyright@ The Insurance Times. 09883398055 / 09883380339