Page 43 - Insurance Times March 2017 Sample

P. 43

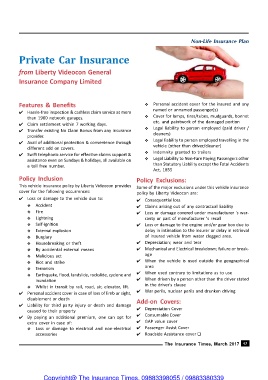

Non-Life Insurance Plan

Private Car Insurance

from Liberty Videocon General

Insurance Company Limited

Features & Benefits Personal accident cover for the insured and any

named or unnamed passenger(s)

Hassle-free inspection & cashless claim service at more

than 1900 network garages. Cover for lamps, tires/tubes, mudguards, bonnet

etc. and paintwork of the damaged portion

Claim settlement within 7 working days.

Legal liability to person employed (paid driver /

Transfer existing No Claim Bonus from any insurance

provider. cleaners)

Avail of additional protection & convenience through Legal liability to person employed travelling in the

different add on covers. vehicle (other than driver/cleaner)

Indemnity granted to trailers

Swift telephonic service for effective claims support &

assistance even on Sundays & holidays, all available on Legal Liability to Non-Fare Paying Passengers other

a toll free number. than Statutory Liability except the Fatal Accidents

Act, 1855

Policy Inclusion Policy Exclusions:

This vehicle insurance policy by Liberty Videocon provides Some of the major exclusions under this vehicle insurance

cover for the following occurrences: policy by Liberty Videocon are:

Loss or damage to the vehicle due to: Consequential loss

Accident Claims arising out of any contractual liability

Fire Loss or damage covered under manufacturer 's war-

Lightning ranty or part of manufacturer 's recall

Self-ignition Loss or damage to the engine and/or gear box due to

External explosion delay in intimation to the insurer or delay in retrieval

Burglary of insured vehicle from water clogged area.

Housebreaking or theft Depreciation; wear and tear

By accidental external means Mechanical and Electrical breakdown; failure or break-

Malicious act age

Riot and strike When the vehicle is used outside the geographical

Terrorism area

Earthquake, flood, landslide, rockslide, cyclone and When used contrary to limitations as to use

inundation When driven by a person other than the driver stated

in the driver's clause

Whilst in transit by rail, road, air, elevator, lift.

War perils, nuclear perils and drunken driving

Personal accident cover in case of loss of limb or sight,

disablement or death Add-on Covers:

Liability for third party injury or death and damage

caused to their property Depreciation Cover

Consumable Cover

By paying an additional premium, one can opt for

extra cover in case of: GAP value cover

Loss or damage to electrical and non-electrical Passenger Assist Cover

accessories Roadside Assistance cover

The Insurance Times, March 2017 43

Copyright@ The Insurance Times. 09883398055 / 09883380339