Page 39 - Insurance Times March 2017 Sample

P. 39

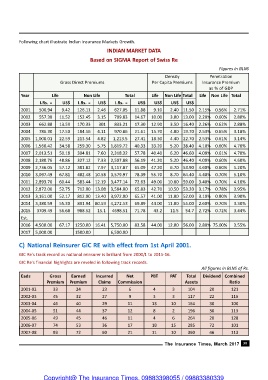

Following chart illustrate Indian Insurance Markets Growth.

INDIAN MARKET DATA

Based on SIGMA Report of Swiss Re

Figures in BLNS

Density Penetration

Gross Direct Premiums Per Capita Premiums Insurance Premium

as % of GDP

Year Life Non Life Total Life Non Life Total Life Non Life Total

I.Rs. = US$ I.Rs. = US$ I.Rs. = US$ US$ US$ US$

2001 500.94 9.42 126.11 2.46 627.05 11.88 9.10 2.40 11.50 2.15% 0.56% 2.71%

2002 557.38 11.52 152.45 3.15 709.83 14.67 10.00 3.00 13.00 2.20% 0.60% 2.80%

2003 662.88 13.59 170.33 301 833.21 17.30 12.90 3.50 16.40 2.26% 0.62% 2.88%

2004 786.30 17.50 184.56 4.11 970.86 21.61 15.70 4.00 19.70 2.53% 0.65% 3.18%

2005 1,000.01 22.59 213.54 4.82 1,213.5 27.41 18.30 4.40 22.70 2.53% 0.61% 3.14%

2006 1,560.42 34.58 259.30 5.75 1,819.72 40.33 33.20 5.20 38.40 4.10% 0.60% 4.70%

2007 2,013.51 50.18 304.81 7.60 2,318.32 57.78 40.40 6.20 46.60 4.09% 0.61% 4.70%

2008 2,180.76 48.86 327.12 7.33 2,507.88 56.19 41.20 5.20 46.40 4.00% 0.60% 4.60%

2009 2,736.05 57.12 381.82 7.97 3,117.87 65.09 47.20 6.70 53.90 4.60% 0.60% 5.20%

2010 3,097.49 67.81 482.48 10.58 3,579.97 78.39 55.70 8.70 64.40 4.40% 0.70% 5.10%

2011 2,893.70 60.44 583.44 12.19 3,477.14 72.63 49.00 10.00 59.00 3.40% 0.70% 4.10%

2012 2,872.00 52.75 712.00 13.08 3,584.00 65.83 42.70 10.50 53.20 3.17% 0.78% 3.95%

2013 3,161.00 52.17 812.00 13.40 3,972.00 65.57 41.00 11.00 52.00 3.10% 0.80% 3.90%

2014 3,380.59 55.30 891.94 80.59 4,272.53 69.89 44.00 11.00 55.00 2.60% 0.70% 3.30%

2015 3709.49 56.68 988.52 15.1 4698.51 71.78 43.2 11.5 54.7 2.72% 0.72% 3.44%

Est.

2016 4,500.00 67.17 1250.00 16.41 5,750.00 83.58 44.00 12.00 56.00 2.80% 75.00% 3.55%

2017 5,000.00 1500.00 6,500.00

C) National Reinsurer GIC RE with effect from 1st April 2001.

GIC Re's track record as national reinsurer is brilliant from 2000/1 to 2015-16.

GIC Re's financial highlights are reveled in following track records.

All figures in BLNS of Rs.

Eads Gross Earned Incurred Net PBT PAT Total Dividend Combined

Premium Premium Claims Commission Assets Ratio

2001-02 33 24 23 6 4 3 104 20 121

2002-03 45 32 27 9 3 3 117 22 116

2003-04 46 40 29 11 13 10 164 30 100

2004-05 51 44 37 12 8 2 196 30 113

2005-06 49 45 46 11 4 6 264 20 128

2006-07 74 53 36 17 18 15 285 72 101

2007-08 93 72 60 21 11 10 360 46 113

The Insurance Times, March 2017 39

Copyright@ The Insurance Times. 09883398055 / 09883380339