Page 40 - Insurance Times March 2017 Sample

P. 40

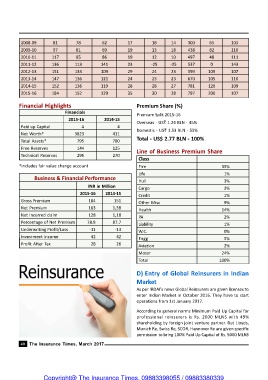

2008-09 81 78 62 17 18 14 300 65 103

2009-10 97 81 69 19 13 18 438 82 110

2010-11 117 95 86 19 12 10 497 48 111

2011-12 136 113 141 23 -25 -25 537 0 143

2012-13 151 133 109 29 24 23 599 109 107

2013-14 147 136 121 24 23 23 670 105 110

2014-15 152 136 119 28 28 27 781 126 109

2015-16 184 152 129 35 30 28 797 200 107

Financial Highlights Premium Share (%)

Financials

Premium Split 2015-16

2015-16 2014-15

Overseas - US$ 1.24 BLN - 45%

Paid up Capital 4 4

Domestic - US$ 1.53 BLN - 55%

Net Worth* 3823 411

Total - US$ 2.77 BLN - 100%

Total Assets* 795 780

Free Reserves 144 125

Line of Business Premium Share

Technical Reserves 295 270

Class

*includes fair value change account Fire 35%

Life 1%

Business & Financial Performance

Hull 3%

INR in Million Cargo 3%

2015-16 2014-15 Credit 1%

Gross Premium 184 151 Other Misc 9%

Net Premium 163 1,38 Health 14%

Net Incurred claim 128 1,18 PA 2%

Percentage of Net Premium 78.8 87.7 Liability 1%

Underwriting Profit/Loss -11 -13 W.C. 0%

Investment Income 42 42 Engg 5%

Profit After Tax 28 26 Aviation 2%

Motor 24%

Total 100%

D) Entry of Global Reinsurers in Indian

Market

As per IRDAI's news Global Reinsurers are given licenses to

enter Indian Market in October 2016. They have to start

operations from 1st January 2017.

According to general norms Minimum Paid Up Capital for

professional reinsurers is Rs. 2000 MLNS with 49%

shareholding by foreign joint venture partner. But Lloyds,

Munich Re, Swiss Re, SCOR, Hannover Re are given specific

permission to bring 100% Paid Up Capital of Rs. 5000 MLNS

40 The Insurance Times, March 2017

Copyright@ The Insurance Times. 09883398055 / 09883380339