Page 50 - Insurance Times March 2017 Sample

P. 50

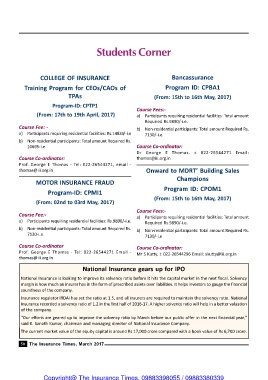

Students Corner

COLLEGE OF INSURANCE Bancassurance

Training Program for CEOs/CAOs of Program ID: CPBA1

TPAs (From: 15th to 16th May, 2017)

Program-ID: CPTP1

Course Fees:-

(From: 17th to 19th April, 2017) a) Participants requiring residential facilities: Total amount

Required Rs.9890/-i.e.

Course Fee: - b) Non-residential participants: Total amount Required Rs.

a) Participants requiring residential facilities: Rs.14835/-i.e 7130/-i.e.

b) Non-residential participants: Total amount Required Rs.

10695-i.e Course Co-ordinator:

Dr George E Thomas. ± 022-26544271 Email:

Course Co-ordinator: thomas@iii.org.in

Prof. George E Thomas - Tel: 022-26544271, email -

thomas@iii.org.in Onward to MDRT’ Building Sales

Champions

MOTOR INSURANCE FRAUD

Program ID: CPOM1

Program-ID: CPMI1

(From: 15th to 16th May, 2017)

(From: 02nd to 03rd May, 2017)

Course Fees:-

Course Fee:- a) Participants requiring residential facilities: Total amount

a) Participants requiring residential facilities: Rs.9890/-i.e. Required Rs.9890/-i.e.

b) Non-residential participants: Total amount Required Rs. b) Non-residential participants: Total amount Required Rs.

7130-i.e.

7130/-i.e

Course Co-ordinator Course Co-ordinator:

Prof. George E Thomas - Tel: 022-26544271 Email - Mr S Kutty. ± 022-26544296 Email: skutty@iii.org.in

thomas@iii.org.in

National Insurance gears up for IPO

National Insurance is looking to improve its solvency ratio before it hits the capital market in the next fiscal. Solvency

margin is how much an insurer has in the form of prescribed assets over liabilities. It helps investors to gauge the financial

soundness of the company.

Insurance regulator IRDAI has set the ratio at 1.5, and all insurers are required to maintain the solvency ratio. National

Insurance recorded a solvency ratio of 1.2 in the first half of 2016-17. A higher solvency ratio will help in a better valuation

of the company.

"Our efforts are geared up to improve the solvency ratio by March before our public offer in the next financial year,"

said K. Sanath Kumar, chairman and managing director of National Insurance Company.

The current market value of the equity capital is around Rs 17,000 crore compared with a book value of Rs 6,700 crore.

50 The Insurance Times, March 2017

Copyright@ The Insurance Times. 09883398055 / 09883380339