Page 44 - Banking Finance MAY 2017

P. 44

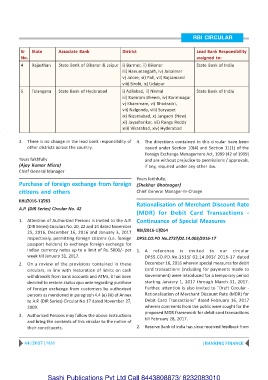

RBI CIRCULAR

Sr State Associate Bank District Lead Bank Responsibility

No. assigned to:

4 Rajasthan State Bank of Bikaner & Jaipur i) Barmer, ii) Bikaner State Bank of India

iii) Hanumangarh, iv) Jaisalmer

v) Jalore, vi) Pali, vii) Rajsamand

viii) Sirohi, ix) Udaipur

5 Telangana State Bank of Hyderabad i) Adilabad, ii) Nirmal State Bank of India

iii) Komram Bheem, iv) Karimnagar

v) Khammam, vi) Bhadradri,

vii) Nalgonda, viii) Suryapet

ix) Nizamabad, x) Jangaon (New)

xi) Jayashankar, xii) Ranga Reddy

xiii) Vikarabad, xiv) Hyderabad

3. There is no change in the lead bank responsibility of 4. The directions contained in this circular have been

other districts across the country. issued under Section 10(4) and Section 11(1) of the

Foreign Exchange Management Act, 1999 (42 of 1999)

Yours faithfully and are without prejudice to permissions / approvals,

(Ajay Kumar Misra) if any, required under any other law.

Chief General Manager

Yours faithfully,

Purchase of foreign exchange from foreign (Shekhar Bhatnagar)

citizens and others Chief General Manager-In-Charge

RBI/2016-17/263

Rationalisation of Merchant Discount Rate

A.P. (DIR Series) Circular No. 42

(MDR) for Debit Card Transactions -

1. Attention of Authorized Persons is invited to the A.P. Continuance of Special Measures

(DIR Series) Circulars No. 20, 22 and 24 dated November

RBI/2016-17/264

25, 2016, December 16, 2016 and January 3, 2017

respectively, permitting foreign citizens (i.e. foreign DPSS.CO.PD No.2737/02.14.003/2016-17

passport holders) to exchange foreign exchange for

Indian currency notes up to a limit of Rs. 5000/- per 1. A reference is invited to our circular

week till January 31, 2017. DPSS.CO.PD.No.1515/ 02.14.003/ 2016-17 dated

2. On a review of the provisions contained in these December 16, 2016 wherein special measures for debit

circulars, in line with restoration of limits on cash card transactions (including for payments made to

withdrawals from bank accounts and ATMs, it has been Government) were introduced for a temporary period

decided to restore status quo ante regarding purchase starting January 1, 2017 through March 31, 2017.

of foreign exchange from customers by authorised Further, attention is also invited to "Draft Circular -

persons as mentioned in paragraph 4.4 (e) (iii) of Annex Rationalisation of Merchant Discount Rate (MDR) for

to A.P. (DIR Series) Circular No.17 dated November 27, Debit Card Transactions" dated February 16, 2017

2009. wherein comments from the public were sought for the

proposed MDR framework for debit card transactions

3. Authorised Persons may follow the above instructions

till February 28, 2017.

and bring the contents of this circular to the notice of

their constituents. 2. Reserve Bank of India has since received feedback from

44 | 2017 | MAY | BANKING FINANCE

Sashi Publications Pvt Ltd Call 8443808873/ 8232083010