Page 52 - Banking Finance MAY 2017

P. 52

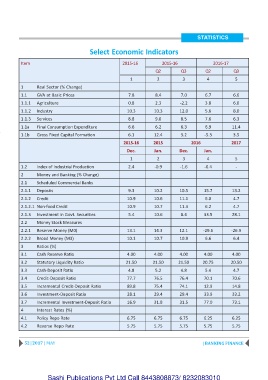

STATISTICS

Select Economic Indicators

Item 2015-16 2015-16 2016-17

Q2 Q3 Q2 Q3

1 2 3 4 5

1 Real Sector (% Change)

1.1 GVA at Basic Prices 7.8 8.4 7.0 6.7 6.6

1.1.1 Agriculture 0.8 2.3 -2.2 3.8 6.0

1.1.2 Industry 10.3 10.3 12.0 5.6 8.0

1.1.3 Services 8.8 9.0 8.5 7.6 6.3

1.1a Final Consumption Expenditure 6.6 6.2 6.3 6.9 11.4

1.1b Gross Fixed Capital Formation 6.1 12.4 3.2 -5.3 3.5

2015-16 2015 2016 2017

Dec. Jan. Dec. Jan.

1 2 3 4 5

1.2 Index of Industrial Production 2.4 -0.9 -1.6 -0.4 -

2 Money and Banking (% Change)

2.1 Scheduled Commercial Banks

2.1.1 Deposits 9.3 10.2 10.5 15.7 13.2

2.1.2 Credit 10.9 10.6 11.1 6.0 4.7

2.1.2.1 Non-food Credit 10.9 10.7 11.3 6.2 4.7

2.1.3 Investment in Govt. Securities 5.4 10.6 8.4 33.5 28.1

2.2 Money Stock Measures

2.2.1 Reserve Money (M0) 13.1 14.3 12.1 -29.6 -26.9

2.2.2 Broad Money (M3) 10.1 10.7 10.9 6.6 6.4

3 Ratios (%)

3.1 Cash Reserve Ratio 4.00 4.00 4.00 4.00 4.00

3.2 Statutory Liquidity Ratio 21.50 21.50 21.50 20.75 20.50

3.3 Cash-Deposit Ratio 4.8 5.2 4.8 5.4 4.7

3.4 Credit-Deposit Ratio 77.7 76.5 76.4 70.1 70.6

3.5 Incremental Credit-Deposit Ratio 89.8 75.4 74.1 12.9 14.8

3.6 Investment-Deposit Ratio 28.1 29.4 29.4 33.9 33.2

3.7 Incremental Investment-Deposit Ratio 16.9 31.8 31.5 77.0 73.1

4 Interest Rates (%)

4.1 Policy Repo Rate 6.75 6.75 6.75 6.25 6.25

4.2 Reverse Repo Rate 5.75 5.75 5.75 5.75 5.75

52 | 2017 | MAY | BANKING FINANCE

Sashi Publications Pvt Ltd Call 8443808873/ 8232083010