Page 20 - Insurance Times March 2021

P. 20

scale." Thus, enabling not just the larger carriers, but Let's categorise the gaps in four high level

carriers of all sizes. AI is nowhere yet close to the level categories and see how AI is enabling start-ups

where it can entirely replace humans, except in movies.

However, AI has now reached a level where it can be the to address these gaps:

best tool that humans can use to deliver their services Data Gaps: A data gap is created when some data fields

better. Insurance has the unique challenge of very low are needed for data analytics-based decisions but the insurer

customer engagement and customer loyalty. AI can be a is not able to capture them. Players are attempting to

great asset to enable insurers to engage with every single provide external data about the customers. They are

customer at a personalized level and create the much leveraging machine learning-based de-duplication and linking

needed connection - financially and emotionally. technologies to identify a unique customer and then provide

additional data about the data

subject from external data

sources. Some players are

helping insurers digitize their

internal data by improving

data capture at each stage of

insurance operations. For

example, optical character

recognition (OCR) and then

natural language processing

(NLP) are used to capture and

logically store data from

existing physical documents.

Process gaps: A process gap

is created when new

technologies having the

potential to transform one or

more steps in insurance value

chain become available, but

the insurer is not able to

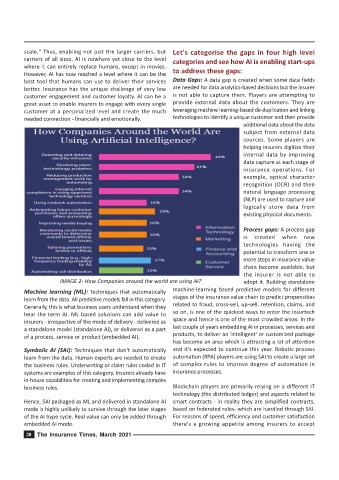

IMAGE 2- How Companies around the world are using AI? adopt it. Building standalone

Machine learning (ML): Techniques that automatically machine-learning based predictive models for different

stages of the insurance value chain to predict propensities

learn from the data. All predictive models fall in this category.

Generally, this is what business users understand when they related to fraud, cross-sell, up-sell, retention, claims, and

so on, is one of the quickest ways to enter the insurtech

hear the term AI. ML based solutions can add value to

insurers - irrespective of the mode of delivery - delivered as space and hence is one of the most crowded areas. In the

a standalone model (standalone AI), or delivered as a part last couple of years embedding AI in processes, services and

products, to deliver an 'intelligent' or customized package

of a process, service or product (embedded AI).

has become an area which is attracting a lot of attention

Symbolic AI (SAI): Techniques that don't automatically and it's expected to continue this year. Robotic process

learn from the data. Human experts are needed to create automation (RPA) players are using SAI to create a large set

the business rules. Underwriting or claim rules coded in IT of complex rules to improve degree of automation in

systems are examples of this category. Insurers already have insurance processes.

in-house capabilities for creating and implementing complex

business rules. Blockchain players are primarily relying on a different IT

technology (the distributed ledger) and aspects related to

Hence, SAI packaged as ML and delivered in standalone AI smart contracts - in reality they are simplified contracts,

mode is highly unlikely to survive through the later stages based on federated rules- which are handled through SAI.

of the AI hype cycle. Real value can only be added through For reasons of speed, efficiency and customer satisfaction

embedded AI mode. there's a growing appetite among insurers to accept

20 The Insurance Times, March 2021